Financially reviewed by Patrick Flood, CFA.

Contrary to popular belief, the Warren Buffett ETF Portfolio is actually a fairly high-risk portfolio. Here we'll check out its components, historical performance, and the best ETFs to use for it in 2025.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

What Is the Warren Buffett ETF Portfolio?

Hopefully Warren Buffett needs no introduction. He is arguably the most successful investor in history, among other things, consistently outperforming the market historically. Don't let this fool you, though. Buffett is the first to admit that retail investors should keep it simple and invest in an S&P 500 index fund.

Warren Buffett himself has never actually written any books. But if you're interested in his style of investing, he has stated that his favorite book is The Intelligent Investor by Benjamin Graham, an excellent introductory resource on Value investing. The recent revised edition contains some great commentary by the legendary Jason Zweig. You can also find the famous collection of Warren Buffett's letters to shareholders over 30+ years here.

The Warren Buffett ETF Portfolio became famous when, in a 2013 letter to Berkshire Hathaway shareholders, Buffett indicated that upon his passing, the trustee of his estate will invest 90% of his wife's inheritance in a low-cost index fund and 10% in short-term government bonds.

Note that Buffett admits that this specific allocation may not be suitable for everyone. More risk-averse investors will (and should) prefer a lower allocation to equities. Young investors almost certainly shouldn't be holding short bonds; more on this later.

Interestingly, recent research from Javier Estrada, professor of finance at the IESE Business School in Barcelona, Spain, suggests that Buffett's prescribed 90/10 asset allocation may actually not be as risky as it appears at first glance, at least in terms of survivability in retirement. Estrada looked at 86 different 30-year intervals between 1900 and 2014, and found that at a typical 4% withdrawal rate in retirement, Buffett's 90/10 portfolio had an extremely low failure rate of only 2.3%, only slightly worse than the traditional “conservative” 60/40 stocks/bonds portfolio.

The Warren Buffett Portfolio asset allocation is as follows:

- 90% US Large Cap Blend

- 10% Short-Term Treasury Bonds

History has shown that indexing the S&P 500 is a solid investment, but I'd definitely prefer to see some allocation to international stocks, as they offer a diversification benefit since they don't move in perfect lockstep with U.S. stocks. Similarly, there's no sensible reason to completely avoid small- and mid-cap stocks that would be included in a total market index fund. Quite the opposite actually; we know that risk factor diversification (small stocks, Value stocks, etc.) conveniently lowers portfolio risk. However, this portfolio bears Buffett's name because it fits his investing style of focusing on U.S. large caps historically. Specifically, Buffett amassed his fortune by identifying underpriced and/or downtrodden large U.S. companies with strong profitability, so he was basically a factor investor before factor investing was a thing, which explains his market outperformance.

In regards to the bonds, 10% in short treasuries simply doesn't make much sense. 90/10 using short bonds still has 99% of the portfolio's risk being contributed by the stocks side. That is, 90/10 using short bonds is not materially different – in terms of volatility and risk – from a 100% stocks portfolio. I think in Buffett's eyes, this 10% is less of a stocks hedge and is simply more like a parking garage for cash. Keep in mind this is just the portfolio in which Buffett's estate is supposed to be invested. It is not necessarily a portfolio he recommends to retail investors. The value of his wife's portfolio can easily sustain huge drawdowns and still cover his her living expenses, so its riskiness is sort of irrelevant for its intended purpose. Retail investors can't say the same. It's almost certain that using long bonds for that 10% would produce superior results (in terms of both general and risk-adjusted returns) for the portfolio as a whole over the long term. Similarly, short bonds would not be appropriate for a young investor with a long time horizon.

Warren Buffett ETF Portfolio Performance Backtest

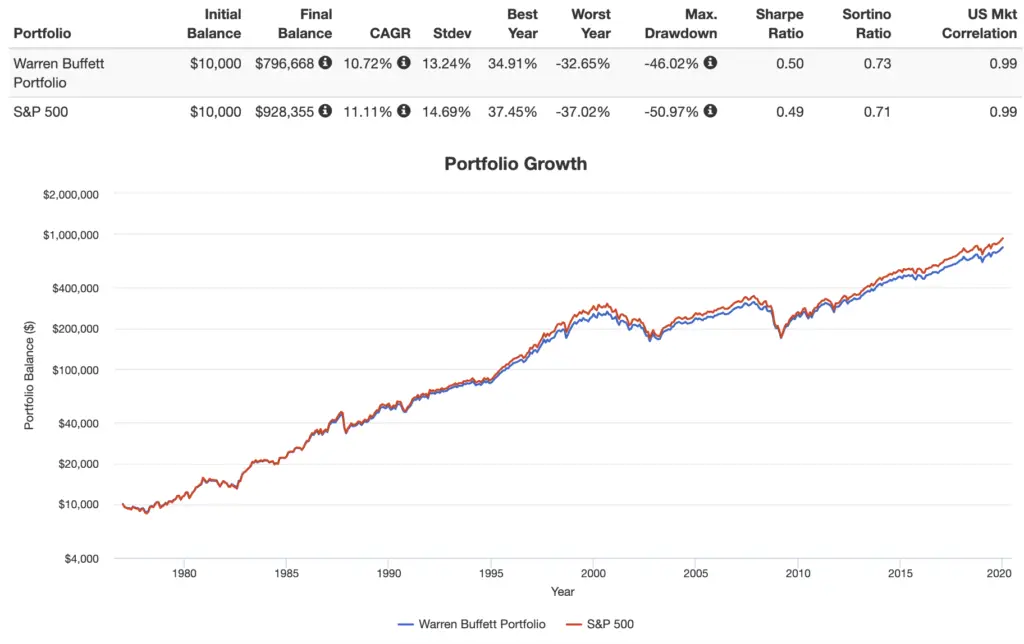

Going back to 1977, here's a comparison of the Warren Buffett ETF Portfolio and the S&P 500 through 2019:

As we'd expect, the results have been very close, with the Warren Buffett achieving a slightly higher risk-adjusted return (Sharpe) due to the small diversification benefit of the inclusion of short-term treasuries.

Warren Buffett Portfolio ETF Pie for M1 Finance

M1 Finance is a great choice of broker to implement the Warren Buffett ETF Portfolio because it makes regular rebalancing seamless and easy with one click, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Using entirely low-cost Vanguard funds, we can construct the Warren Buffett Portfolio pie with the following ETFs:

- VOO – 90%

- VGSH – 10%

You can add the Warren Buffett Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Invest in this pie.” Investors outside the U.S. can use eToro.

Global Stocks and Long Bonds

This post would feel incomplete if I didn't offer up a version with the suggestions I mentioned above, namely diversifying globally with stocks and using long bonds instead of short bonds. This pie would look like this:

VT – 90%

VGLT – 10%

You can add this global version to your portfolio on M1 Finance by clicking this link and then clicking “Invest in this pie.” Canadian investors can use Questrade, and those outside North America can use eToro.

Right now M1 is offering a transfer promotion of a 0.50% payout on settled transfers over $10,000 into Invest accounts before January 31 with a max payout of $25,000. Terms for this promotion are here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosure: I am long VOO in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

John

the expert pies have stocks in them and they (I assume change, when Buffett.. buys or sells) on every filing, does that impact your current allocation? Does the expert pie change the stocks when you rebalance, to the new filing? For a taxable account, it only makes sense to rebalance after a year to avoid short-term capital gain, right?

I appreciate your help.

Paul, the Expert Pie from M1 does indeed change based on quarterly 13F filings. That is not the portfolio I’m discussing here. Yes, selling in a taxable account before holding for a year would incur STCG.

Two minor children are starting Roth IRAs through their earned income. They obviously have a long horizon. Any thoughts about QQQM vs SPYG or VTI? Market dip is making this a tougher choice.

Those first 2 are poorly diversified. Current market behavior should not affect the choice. It’s also sensible to diversify internationally.

10% in short treasuries makes a lot of sense for the reason you stated – a parking garage for cash. We need this during the downturns like 2008 when selling stocks at the bottom is *really* damaging. This is why Mr. Buffett didn’t simply say 100% stocks.

Remember that we aren’t Buffett, though. View the portfolio holistically, not as individual buckets. We’d expect to come out ahead using longer duration bonds, and indeed that has been the case historically.

Hi John:

Beginner here: could you do a “vs” video for voo vs qqq

Also, in general I hate brick and mortar bank savings accounts…is there an etf or etf combination that can replace a savings account and actually help oir savings.

Thanks

Sure, I’ll add that comparison to the list. For a brief summary, VOO tracks the S&P 500, which is a sufficient proxy for the whole U.S. stock market; it’s the 500 largest U.S. stocks across all sectors. QQQ is just the NASDAQ 100 index. It’s a small subset of the S&P 500 in that it’s almost entirely large Growth stocks and is thus mostly tech companies. QQQ should not replace a broad market index fund like VOO as a core holding IMHO because it is not well diversified.

As for a savings account replacement, you might like this post.

How do you get the portfoliovisualizer plots? I tried with 90/10 VOO/VGSH on portfolioviusalizer but backtest only starts at 2011 eventhough I have the period set to start from 1985

Use “Backtest Asset Allocation”.