VT and VTI are two very popular index funds from Vanguard. Here we'll dive into their differences, similarities, performance, and why you might want one over the other.

In a hurry? Here are the highlights:

- VT and VTI are two completely different funds. Both are from Vanguard.

- VT has a mutual fund equivalent VTWAX. VTI has a mutual fund equivalent VTSAX.

- VT is the entire global stock market. VTI is just the U.S. stock market.

- As such, VT can be considered more diversified than VTI.

- VT holds about 8,500 stocks, while VTI holds about 4,000 stocks.

- VTI has outperformed VT historically.

- If you use VTI, you should probably still utilize some international diversification of some sort.

- VT has an expense ratio of 0.08%, while VTI is 0.03%.

Contents

VT vs. VTI – Video

Prefer video? Watch it here:

VT vs. VTI – Methodology, Composition, and Reasoning

First and foremost, understand that even though their tickers only differ by the addition of a single letter, VT and VTI are two completely different funds, and one should not be considered a replacement for the other.

Let's talk about index funds in general for a second. Why would you want to buy either of these funds? If you've landed here, you probably already know that stocks are a significant driver of portfolio returns, and that index funds are a great, low-cost way to get immediate, broad diversification across all sectors of the stock market. You also probably already know that Vanguard has some of the lowest fees around and has a solid track record of providing ETFs that accurately track their indexes.

VT is the Vanguard Total World Stock ETF. As the name suggests, it's a market cap weighted fund that holds the global stock market. Specifically, VT seeks to track the FTSE Global All Cap Index. Its mutual fund equivalent is VTWAX. It holds everything in the world – all sectors, all styles, all cap sizes, and all geographies (except frontier markets). It's the broadest index fund out there. If you want to be 100% stocks and you don't want to bother betting on specific countries or cap sizes or styles or whatever, just buy this fund and call it a day, and you can brag to your friends that you own over 8,500 stocks in your portfolio. Come back 30 years later and enjoy your gains. Doesn't get much simpler.

VTI, on the other hand, is the Vanguard Total Stock Market ETF. Its mutual fund equivalent is VTSAX. I'm not sure why Vanguard doesn't include “US” in the name, because at a glance you might reasonably think the name of this fund implies that it is the total global stock market. It's not. This is just the total U.S. stock market. Like VT, it's market cap weighted. Specifically, the fund seeks to track the CRSP US Total Market Index. So we're talking about all sectors, styles, and cap sizes, but only within the U.S. There are no international stocks in VTI. So while the fund still holds nearly 4,000 stocks, it is much more concentrated than VT, as VT holds the U.S. plus all the other countries in the world. As such, VT can be considered much more diversified than VTI.

So now you can see why I said one of these funds should not be considered a replacement for the other. One is the global stock market. One is just the U.S. stock market. The former includes the latter. Specifically, the U.S. (VTI) comprises about 55% of the global stock market (VT) at its global market weight. So these are very different funds, obviously. What this two-fund comparison per se is ignoring is the fact that an investor wanting to be globally diversified who holds VTI will almost certainly also be pairing it with VXUS, the Vanguard Total International Stock ETF. That is, VTI plus VXUS equals VT.

Someone using VTI and VXUS together likely wants to dial in their own allocation to U.S. and international stocks, while the investor using VT just accepts the global market cap weights. Specifically, most investors doing the former are likely wanting to bet on the U.S. by overweighting it relative to the rest of the global market. For a U.S. investor doing this, this is called home country bias.

But this comparison isn't about VXUS. Back to the topic at hand. Now let's look at the performance of VT vs. VTI, which is usually the reason people choose one over the other.

VT vs. VTI – Historical Performance

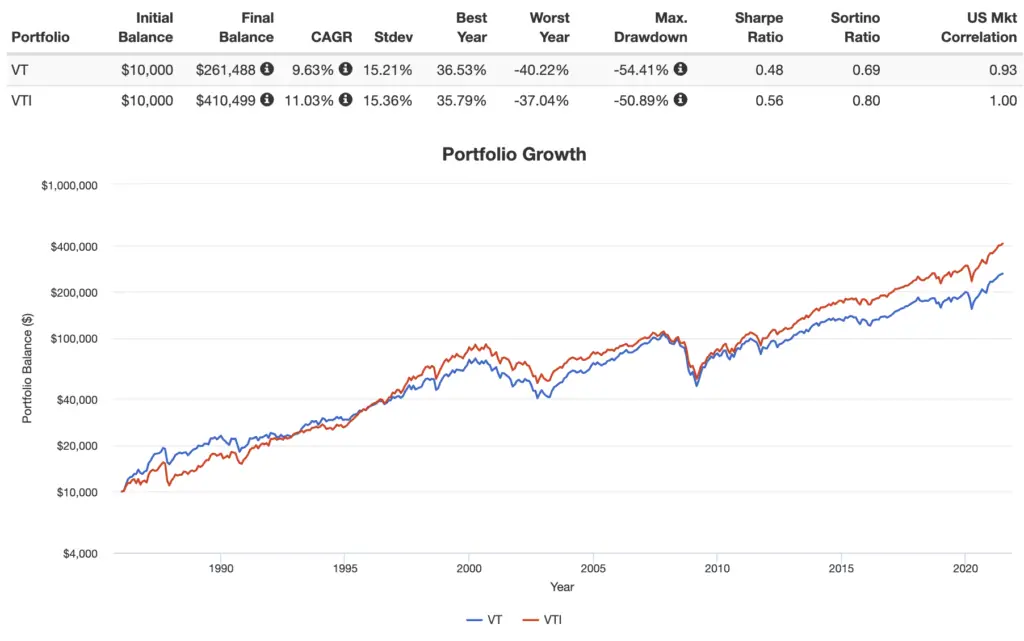

Here's the global stock market (VT) vs. the U.S. stock market (VTI) from 1986 through June, 2021:

So we should obviously pick VTI then, right? Not so fast. In the next section we'll talk about why this isn't such a simple decision.

VT vs. VTI – Reasoning Behind Global Diversification

So again, a decision between just these two funds comes down to betting entirely on the U.S. (VTI) or getting global diversification with markets outside the U.S. (VT).

Yes, the U.S. has been the king of the global stock market. That's why its market cap weight inside VT is a whopping 55%, drastically outweighing every other country in the global market. Does that mean it will always be that way? Of course not. In that sense, the VT investor is more agnostic toward global markets and the performance of different countries relative to each other.

It may seem intuitive and sensible to bet entirely on the U.S. and go 100% VTI. Again, the U.S. is a powerhouse in the global market. On the whole, its stocks have outperformed the broader global market historically. Why wouldn't that continue? Let's bet on the winning horse.

Well, it's not that simple. Here are some sobering facts that will hopefully open your eyes to international diversification beyond U.S. borders.

First, realize that stock market returns are not correlated with economic performance. Yes, you read that right. I'll say it again. Economic output is not correlated with stock market performance. The historical correlation between GDP and stock market returns has been roughly zero. The economy is not the stock market, and the stock market is not the economy.

Presidents famously like to point to a rising stock market as an indicator of a good economy. They're wrong. Pundits on media outlets speculate on monthly, weekly, and even daily market movement as a result of economic activity. They're wrong, too. The stock market simply illustrates the expectations of investors about the futures of publicly traded companies. Period.

Here are a few examples to explain. The U.S. economy was in the toilet in 2020, but the S&P 500 Index – considered a sufficient proxy for the U.S. stock market – returned a positive 12% for the year. Historically, The stock market of South Africa has outpaced the U.S. stock market. It should strike you as obvious that one shouldn't only invest in South African stocks, even if you live in South Africa. Going broader, Emerging Markets stocks have crushed U.S. stocks historically.

Let's put some numbers to this idea of global diversification.

Again, at global market cap weights, U.S. stocks only comprise about half of the global market. International stocks don’t move in perfect lockstep with U.S. stocks, offering a diversification benefit. This is the whole point of diversification in the first place. If U.S. stocks are declining, international stocks may be doing well, and vice versa.

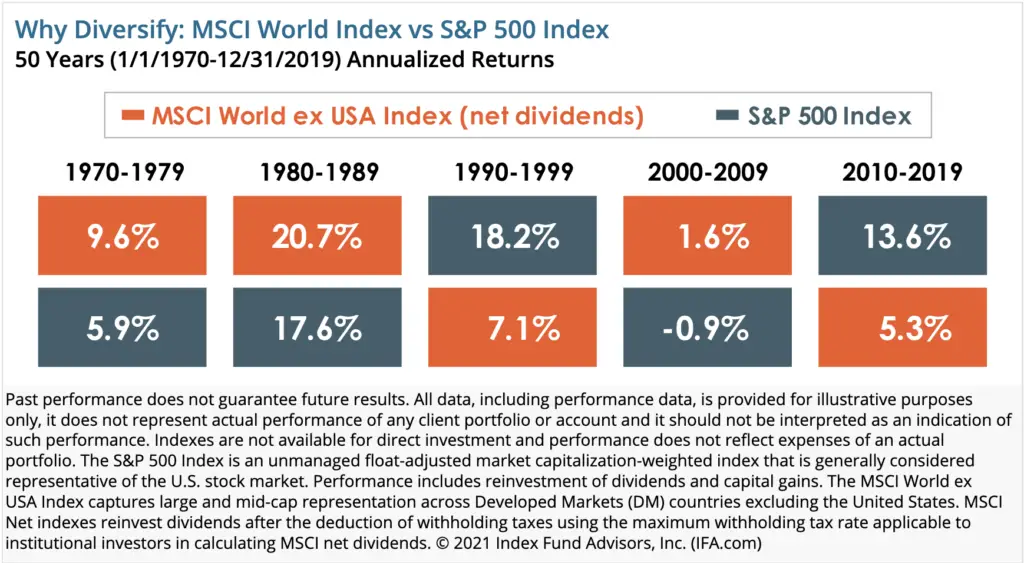

No single country consistently outperforms all the others in the world. If one did, that outperformance would also lead to relative overvaluation and a subsequent reversal. Meb Faber found that if you look at the past 70 years, the U.S. stock market has outperformed foreign stocks by 1% per year, but all of that outperformance has come after 2009.

“But U.S. companies do business overseas,” people exclaim. I've always found that argument pretty silly. Excluding stocks outside the U.S. means you’re missing out on leading companies that happen to be based elsewhere. Similarly, there have been periods where a global portfolio outperformed a U.S. portfolio. During the period 1970 to 2008, an equity portfolio of 80% U.S. stocks and 20% international stocks had higher general and risk-adjusted returns than a 100% U.S. stock portfolio. Specifically, international stocks outperformed the U.S. in the years 1986-1988, 1993, 1999, 2002-2007, 2012, and 2017.

Emerging Markets and international small cap stocks have crushed the U.S. market historically, for example, as they’re considered riskier, and investors are compensated on average for that greater risk. And this is just talking about performance. The volatility and risk reduction benefits are another conversation entirely, which is of huge significance for a retiree. If I were writing this in 2010 (or 1990, or 1980), we'd be talking about how a global portfolio beat a U.S. portfolio the previous decade. The important takeaway is that it's impossible to know when the performance pendulum will swing and for how long, much less how those time periods would match up with your personal time horizon and retirement date.

Dalio and Bridgewater maintain that global diversification in equities is going to become increasingly important given the geopolitical climate, trade and capital dynamics, and differences in monetary policy. They suggest that it is now even less prudent to assume a preconceived bet that any single country will be the clear winner in terms of stock market returns.

In short, geographic diversification in equities has huge potential upside and little downside for investors.

VT vs. VTI – AUM and Fees

Though both funds are highly liquid and extremely popular, VTI is much more popular with over $250 billion in assets under management. VT has about 1/10 of that at $23 billion. There are probably a couple reasons for this. First, VTI was launched much earlier in 2001, while VT launched in 2008. Secondly, as I said, many investors are using VTI and VXUS for a home country bias. Lastly, target date funds are doing the same and are using VTI and VXUS instead of VT.

VT has an expense ratio of 0.08%, compared to 0.03% for VTI.

Conclusion

While they're both very popular, have low fees, and reliably track their respective indexes, Vanguard's VT and VTI are two completely different funds. The former is the entire global stock market, while the latter is just the U.S. stock market. I'm a huge fan of diversification across geographies. In any case, don't use VTI alone. So the question becomes: Do you want to be completely hands-off and use VT to get the market cap weights of the world or would you rather use VTI in conjunction with VXUS (or your international fund of choice) for some home country bias and rebalance regularly?

Conveniently, both of these funds should be available at any broker, including M1 Finance, which is the one I'm usually suggesting around here.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

What do you think of VT and VTI? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

I, too, advocate use of the Oxford comma.

Like some of the other commenters here, I am beginning to invest later in life (39 years old). My first course of action is maxing out Roth IRA contributions for both my wife and I. I have been trying to nail down a portfolio strategy, but every time I think I arrive at the right mix, I read another article like yours that steers me in yet another direction. At least each time I read an article the total number of prospect tickers shrinks. Your article is the clearest I have found that spells out the benefit of diversifying as much as possible. Not only that, I can get the best diversification buying only one fund!

What are your thoughts on dollar-cost averaging and how far would you take it? Robinhood now offers IRA accounts. Although some of Robinhood’s interventions with trading give me pause, I really like how Robinhood allows the user to set-up recurring purchases of fractional shares of stocks or ETFs as often as once daily and for dollar amounts as low as one dollar. What do you think of purchasing $25 per day, every trading day, of VI in my and my wife’s Roth IRAs?

.

Thanks Bennett! Glad you’ve found them helpful. On average, it’s best to get money in the market as soon as it becomes available. I discussed the suboptimality of dollar cost averaging in a separate post here.

Great article! I love the way you explain things, very simple and straightforward. I have both VTI and VT in my portfolio, about twice as much VTI to VT. Just getting started in investing, late in life, but better late then never. I’m all vanguard, all funds and etf’s but getting ready to start adding stocks. My first thought is to start building a position with Microsoft.

I will continue to follow you now.

Thanks, Paul!

What ratio of VTI to VXUS do you recommend in a taxable account for a 37 yr old?

Thanks,

Whatever ratio allows you to stay the course and not have regret. Letting the market decide may be best, which is VT.

Hello. Can´t convince my self of the risk adjusted return to go VT, instead VTI. Maybe diversify a bit on non US Developed Market. What is your thoughts on 40% IVV, 40% QQQ (I know that 80% is already inside IVV) and 20% IEUR?

Regards

Under-diversified and way too concentrated in tech. Risk-adjusted return is not the reason to go VT.

Finally made time to read this. One option you didn’t touch on that I think is very valid is to use VT with VTI such as 90% VT and 10% VTI to ensure a 10% home country bias over global market cap weights. If VTI performs better, the investor benefits. If VTI performs worse for a period, VTI is now on sale and may comprise less of VT, This results in that 10% of capital staying with the US, allowing the investor to maintain a relative home country bias. VTI/VXUS only provides a set allocation that does not stay quite as in-line with global market cap weights overtime.

I’d argue this is largely just mental accounting. Any index fund is self-cleansing. With VT, one will get more exposure to whatever country is experiencing success at the moment. Home country bias should not automatically be preferable. You noted using VTI/VXUS gets away from global market cap weights, but so does VT/VTI. It’s impossible to know which route will perform best in the future.

I use $VTI in my Roth IRA account. I read JL Collins book all about $VTSAX. I use Fidelity so purchasing ETFs is Free.

I read your post on $VWO & $VEA and I have a position in both of them.

I also use $VOO in my HSA account.

I started very late is saving for retirement. But I’m saving about 35% to 40% of my income play catch up with my investments.

Enjoy your Twitter posts / writings. Your teaching me brother !!

Sounds great! Thanks!