Two popular dividend growth ETFs are VIG, the Vanguard Dividend Appreciation ETF, and DGRO, the iShares Core Dividend Growth ETF. Let's compare them.

To be clear, I don't obsess over dividends. But I know income investors often like to use dividends as current income, particularly in retirement, and thus seek out dividend-oriented funds. Others just irrationally prefer dividend-paying stocks. In any case, it's impossible to avoid seeing and hearing about dividend investors' preferences of these dividend-focused ETFs. VIG and DGRO are the two most popular funds out there for capturing dividend growth stocks. I actually included both VIG and DGRO in the dividend portfolio I designed for income investors. Here we'll review their differences and similarities.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here are the highlights:

- VIG and DGRO are two popular dividend growth ETFs from Vanguard and iShares, respectively.

- VIG requires 10 years of consecutive dividend growth, while DGRO only requires 5 years.

- As such, DGRO has more holdings than VIG and has been slightly more volatile historically.

- Both funds exclude REITs and the highest yielding stocks in their selection universes.

- VIG is cheaper with a fee of 0.06% versus 0.08% for DGRO.

- Since DGRO's inception in 2014, it has outperformed VIG with slightly greater volatility and a larger max drawdown.

- By definition, dividend growth funds are not high yield funds, and instead aim to capture companies with predictable and sustainable earnings.

- This would make a great pair for tax loss harvesting.

Contents

Video

Prefer video? Watch it here:

VIG vs. DGRO – Methodology, AUM, Dividend Yield, and Fees

VIG and DGRO are both dividend growth funds that capture companies that have increased their dividend over time.

VIG, the Vanguard Dividend Appreciation ETF seeks to track the S&P U.S. Dividend Growers Index. These are U.S. companies with at least 10 consecutive years of an increasing dividend payment. VIG launched in 2006, has about $60 billion in assets, and has a mutual fund equivalent VDADX. The fund is market cap weighted, and individual holdings are capped at 4%.

Note that VIG is not exactly a high-yield fund. In fact, in order to prevent the fund being exposed to dividend cuts and potential financial distress, it excludes the top 25% highest yielding stocks from its selection universe. REITs are also excluded. VIG has a little under 300 holdings.

Dividend growth funds are not designed strictly for income. These methodologies are meant to capture stable companies with robust, predictable earnings and subsequent potential insulation from market crashes. As such, pure yield chasers may shy away from funds like VIG and DGRO.

DGRO is the iShares Core Dividend Growth ETF. The fund launched in 2014 and seeks to track the Morningstar U.S. Dividend Growth Index. The main difference between DGRO and VIG is that DGRO is more inclusive by only requiring 5 years of a growing dividend as opposed to 10 years for VIG.

DGRO also excludes companies that pay out more than 75% of their earnings as dividends as well as the top 10% highest yield stocks in its universe. Individual holdings are capped at 3%. Like VIG, DGRO also excludes REITs. DGRO has a little over 400 holdings.

VIG and DGRO have an overlap of about 66% by weight, which is 244 holdings. As we'd expect due to their similar methodologies, most of VIG's holdings are already inside DGRO. Top holdings shared by both funds include household names like Johnson & Johnson, Microsoft, Procter & Gamble, and Coca-Cola.

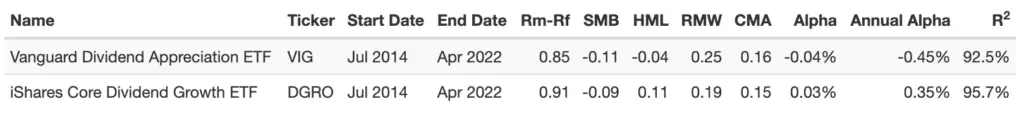

In terms of factor exposure, since DGRO's inception in 2014, as we would expect, it has small positive loadings across Value, Profitability, and Investment, with a small negative loading on Size. VIG provides pretty similar exposure except it actually has a slight negative loading on Value:

DGRO has about 1/3 the assets of VIG at roughly $20 billion.

Again, yield chasers may not care too much for either of these funds, but DGRO has a slightly higher yield at about 2.2% at the time of writing, as opposed to 2.0% for VIG.

VIG is cheaper with a fee of 0.06%, compared to 0.08% for DGRO.

VIG vs. DGRO – Sector Composition

As we'd probably expect, sector exposure is extremely similar between VIG and DGRO, with both having above-market weights for Consumer Staples, Financials, and Industrials:

| VIG | DGRO | |

| Basic Materials | 4.6% | 2.9% |

| Consumer Staples | 13.6% | 12.5% |

| Consumer Discretionary | 8.8% | 6.8% |

| Financials | 20.3% | 20.3% |

| Energy | 0.1% | 1.1% |

| Healthcare | 15.9% | 18.7% |

| Industrials | 14.5% | 13.7% |

| Technology | 16.8% | 17.3% |

| Telecommmunications | 2.2% | 1.6% |

| Utilities | 3.3% | 5.0% |

| Real Estate | 0.0% | 0.0% |

VIG vs. DGRO – Performance

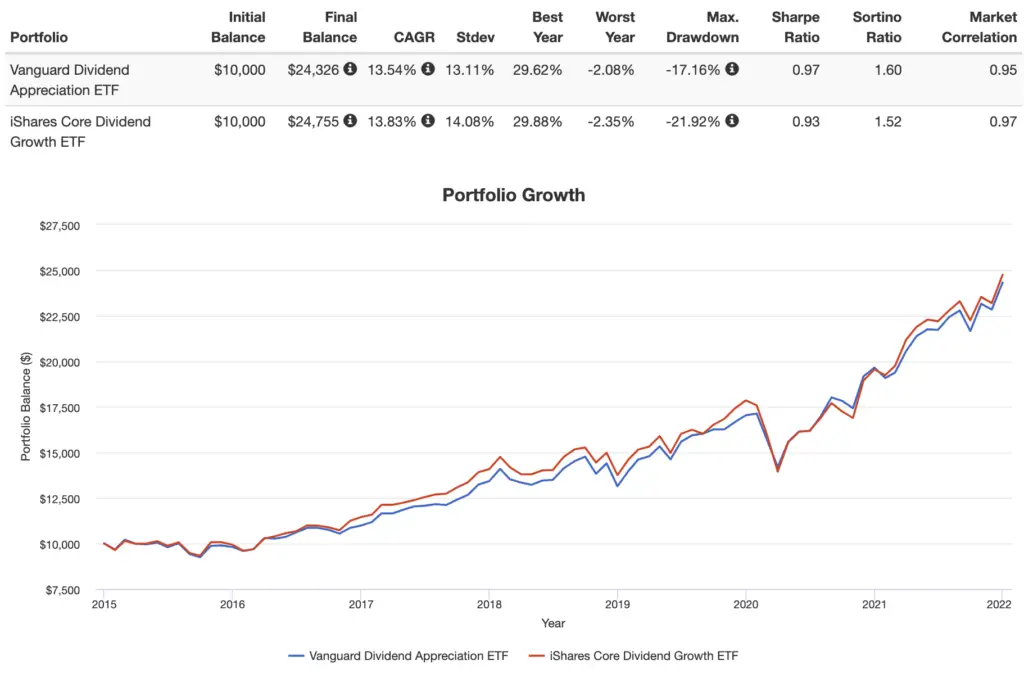

Since DGRO's inception in 2014, it has outperformed VIG through 2021 but with slightly greater volatility and a larger drawdown, so VIG has still delivered a slightly greater risk-adjusted return.

Conclusion

Looking at these two dividend growth funds, DGRO is more inclusive with its lower 5-year dividend growth requirement, is more diversified with more holdings, and has outperformed VIG historically, but it's also more expensive than VIG by 2 bps. Since these two funds are pretty similar, they make a good pair for tax loss harvesting.

Remember that both of these funds exclude REITs and both are specifically designed to not be high-yield funds. I designed a dividend portfolio that includes VIG and DGRO here.

Conveniently, both of these funds should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

What do you think of VIG and DGRO? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply