Financially reviewed by Patrick Flood, CFA.

The Paul Merriman Ultimate Buy and Hold Portfolio specifies very specific market segments based on historical outperformance. Here we’ll take a look at its components, performance, and the best ETFs to use in its implementation in 2025.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Ultimate Buy and Hold Portfolio Review Video

Prefer video? Watch it here:

Who Is Paul Merriman?

Paul Merriman is a financial advisor and educator who is extremely popular in the financial blogosphere for his assessments on index investing and asset allocation in relation to long-term buy-and-hold investing strategies.

Merriman founded an investment advisory firm in Seattle in 1983, from which he has since retired. He is regularly published on MarketWatch.com, and offers free podcasts, articles, newsletters, and more on his website PaulMerriman.com.

Merriman has written a number of highly-rated books that you can find on Amazon here. His newest one from November, 2020 is We're Talking Millions!: 12 Simple Ways to Supercharge Your Retirement. You can read more about him on his website here.

He also designed the Paul Merriman 4 Fund Portfolio.

What Is the Paul Merriman Ultimate Buy and Hold Portfolio?

The Paul Merriman Ultimate Buy and Hold Portfolio, as the name suggests, is a lazy portfolio designed by Paul Merriman for a buy-and-hold investing strategy. It probably has the longest name of all the lazy portfolios, but that's okay with me.

To design the portfolio, Merriman looked historically at the very specific market segments that had the greatest and most consistent historical outperformance across stocks of all cap sizes globally. Specifically, he maintains that the term “ultimate” must describe a portfolio that has consistently outperformed the S&P 500 with no additional risk.

Merriman himself updates the performance of the Ultimate Buy and Hold Portfolio annually and occasionally swaps out his “best-in-class” ETF recommendations based on tracking, factor exposure, and fees. He is constantly attempting to further optimize the portfolio at the margin. I can get behind that. This post has been updated to reflect Merriman's best-in-class ETF recommendations for 2025, which satisfyingly rely heavily on offerings from Avantis.

Consistent with investing wisdom of a 60/40 portfolio being the “center of gravity” between risk and return, the Ultimate Buy and Hold Portfolio allocates 60% to stocks and 40% to bonds. As I've covered before, this provides long-term growth from stocks combined with volatility and risk reduction from bonds. However, Merriman acknowledges that this asset allocation may not be appropriate for everyone, and suggests that investors should choose their own allocation based on their own personal risk tolerance. I discussed how to do that here.

Let's look at the specific asset choices.

Bonds

The bond side of the Ultimate Buy and Hold Portfolio is easier to cover than the stocks side. Merriman advocates for strictly using treasury bonds over corporate bonds. I agree with this wholeheartedly. He specifically suggests using 50% intermediate-term treasury bonds, 30% short-term treasury bonds, and 20% inflation-protected bonds (TIPS).

I personally feel the average bond duration of those allocations is much too conservative for most investors, and that investors should aim to roughly match bond duration to their investing horizon, but for the sake of this post, I'm going to leave Merriman's recommendations unchanged. Again, he suggests that a 60/40 allocation may not be appropriate for everyone.

Merriman explicitly acknowledges that “the Ultimate Buy and Hold Strategy takes calculated risks in stocks while being very conservative on the bond side.” It keeps 12% of the total portfolio in short-term bonds, considered a cash equivalent.

Stocks

The equities side of the Merriman Ultimate Buy and Hold Portfolio is much more complex and nuanced. Merriman walks us through these steps of construction:

- Start with a basis of large-cap U.S. stocks, accessible via the S&P 500 index.

- Diversify with REITs, as they have historically had a low correlation to the stock market.

- Small stocks have historically outperformed large stocks, so small-caps are overweighted. This is known as the Size premium.

- Value stocks – companies that are believed to be underpriced – have historically outperformed Growth stocks, so Value stocks are overweighted. This is known as the Value premium.

- A truly diversified equities portfolio must incorporate international stocks, so half of the equities side is put in international stocks, again specifically overweighting small-cap and value stocks, as well as Emerging Markets.

My own portfolio draws heavily from the analysis and recommendations by Merriman, specifically as it relates to tilting toward the Size and Value factor premia and overweighting Emerging Markets.

Paul Merriman Ultimate Buy and Hold Portfolio Asset Allocation

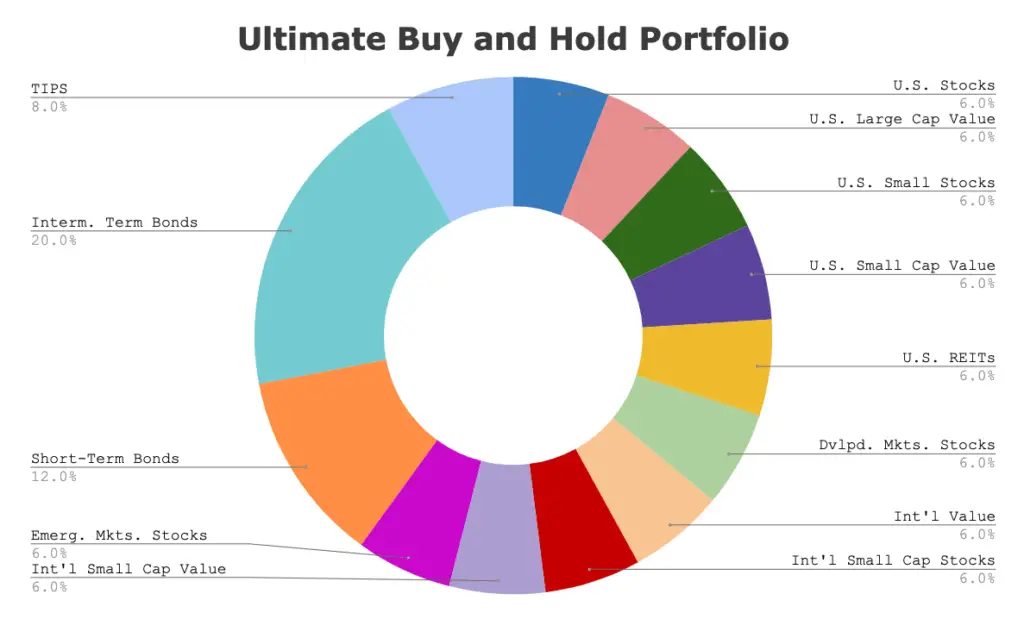

Combining all these steps, the Paul Merriman Ultimate Buy and Hold Portfolio asset allocation is as follows:

- 6% U.S. Total Stock Market

- 6% U.S. Large Cap Value

- 6% U.S. Small Cap Stocks

- 6% U.S. Small Cap Value

- 6% U.S. REITs

- 6% International Developed Markets Stocks

- 6% International Value

- 6% International Small Cap Stocks

- 6% International Small Cap Value

- 6% Emerging Markets Stocks

- 12% Short-Term Treasury Bonds

- 20% Intermediate-Term Treasury Bonds

- 8% TIPS

Paul Merriman Ultimate Buy and Hold Portfolio Performance vs. the S&P 500 and 60/40

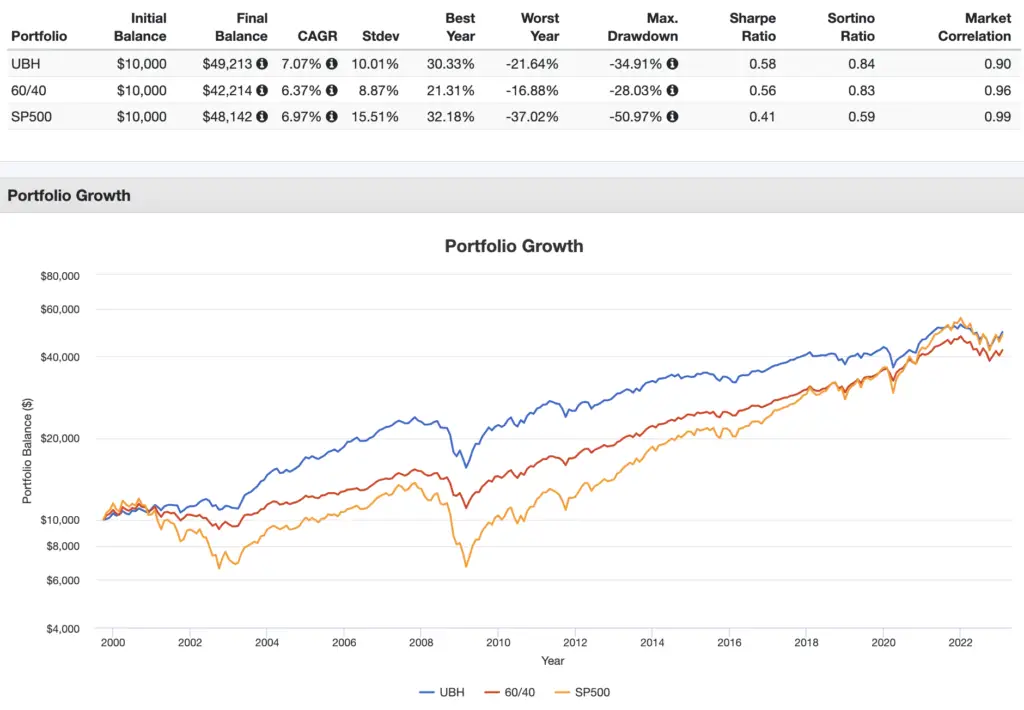

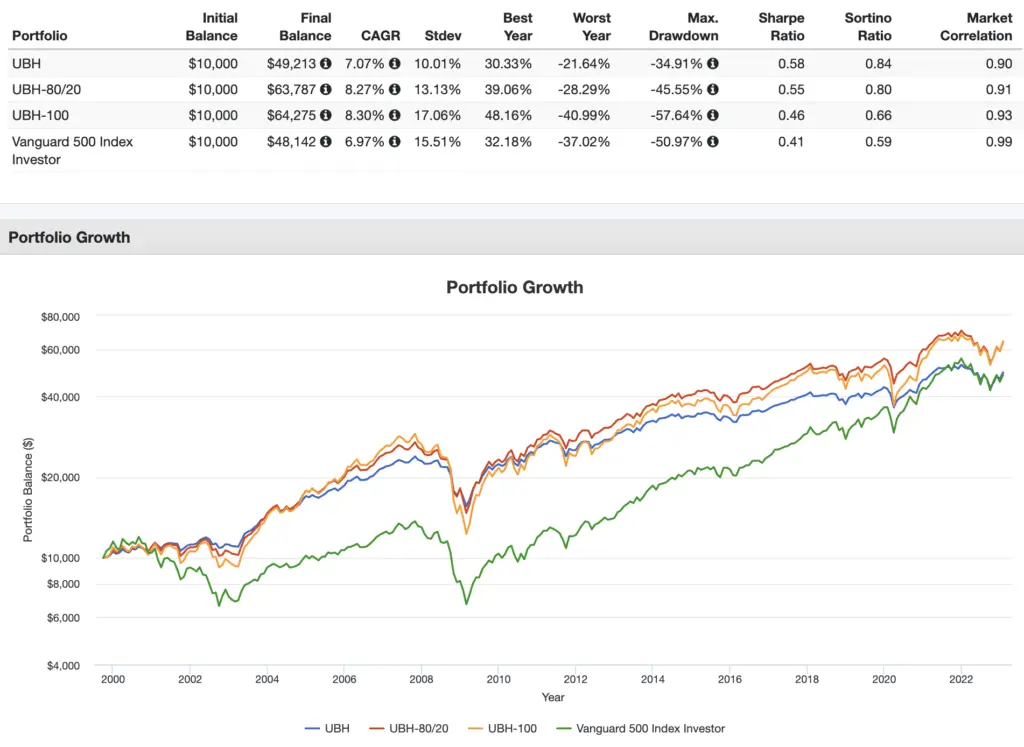

Using live fund data going back to 1999, here's the Ultimate Buy and Hold Portfolio's performance vs. a traditional 60/40 portfolio (using interm. treasuries) and an S&P 500 index fund through 2022:

Over that time period, the Merriman Ultimate Buy and Hold Portfolio has delivered a slightly higher return with similar risk metrics to a traditional 60/40. Notice how its volatility was roughly 1/3 less than that of the S&P 500 and its max drawdown was much smaller.

Looking at the 5-year rolling returns, we can see how the UB&H portfolio's factor exposure and international diversification shined in the early 2000's and suffered during the latter years of the backtest:

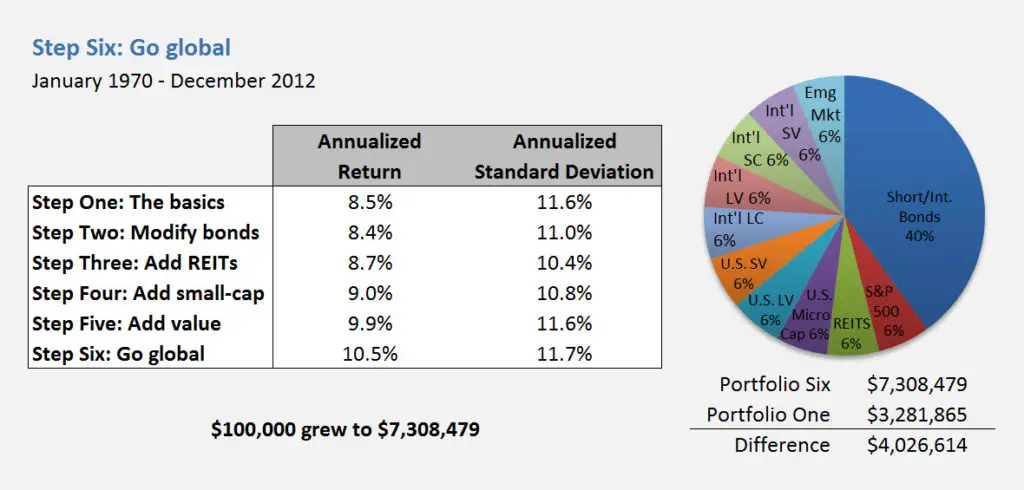

Below are the results from 1970 from Merriman's website corresponding to each step of the portfolio's construction:

Paul Merriman Ultimate Buy and Hold Portfolio ETF Pie for M1 Finance

M1 Finance is a great choice of broker to implement the Ultimate Buy and Hold Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Merriman's best-in-class ETF recommendations for 2025 rely heavily on fund offerings from Avantis, a relatively new ETF provider founded by former Dimensional employees. The important takeaway is that we would expect Avantis funds to provide reliable factor targeting (e.g. Size, Value, etc.), and indeed they have in their short lifespan so far. We can construct the Ultimate Buy and Hold Portfolio for 2025 like this:

- AVUS – 6%

- RPV – 6%

- IJR – 6%

- AVUV – 6%

- VNQ – 6%

- AVDE – 6%

- DFIV – 6%

- FNDC – 6%

- AVDV – 6%

- AVEM – 6%

- VGSH – 12%

- SPTI – 20%

- VTIP – 8%

You can add the Ultimate Buy and Hold Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Going More Aggressive with 80/20 and Longer Duration Bonds

If you're like me, you might want to use a one-size-fits-most 80/20 allocation instead of 60/40 and just use long-term treasury bonds on the fixed income side. I delved into the reasoning for this here.

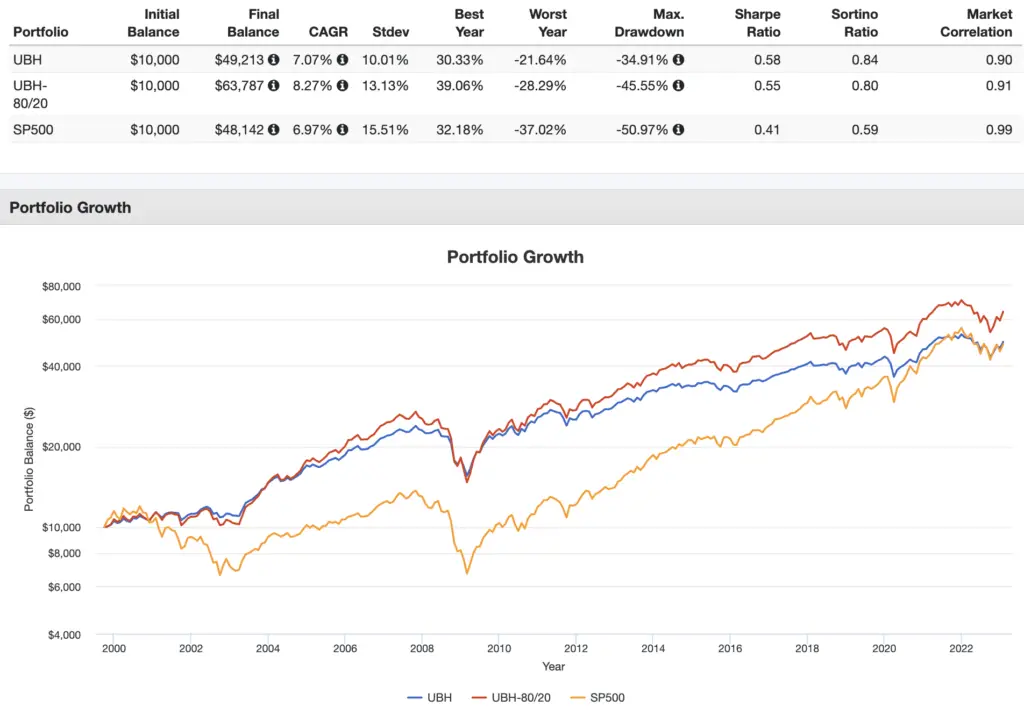

Using the same backtest above, I've added my modified version as “UBH-80/20” Note that the colors below may be different from the earlier backtest.

The 80/20 would have yielded a higher return with a slightly lower risk-adjusted return (Sharpe ratio).

This 80/20 modified Ultimate Buy and Hold Portfolio then becomes:

- AVUS – 8%

- RPV – 8%

- IJR – 8%

- AVUV – 8%

- VNQ – 8%

- AVDE – 8%

- DFIV – 8%

- FNDC – 8%

- AVDV – 8%

- AVEM – 8%

- VGLT – 20%

To add this pie to your portfolio on M1 Finance, click this link and then click “Save to my account.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Aggressive Ultimate Buy & Hold Portfolio – 100/0

Young investors with a long time horizon and/or a high tolerance for risk may desire to go 100% stocks and zero bonds. Removing the bonds knocks it down to 10 funds. This one is actually sometimes specifically referred to as the “Paul Merriman 10 Fund Portfolio.”

Here's what Merriman's Aggressive Ultimate Buy & Hold Portfolio looks like:

- AVUS – 10%

- RPV – 10%

- IJR – 10%

- AVUV – 10%

- VNQ – 10%

- AVDE – 10%

- DFIV – 10%

- FNDC – 10%

- AVDV – 10%

- AVEM – 10%

And in the interest of full disclosure, here's the backtest for this aggressive version versus the original 60/40 version and the S&P 500:

As we would expect, this aggressive 100% stocks version of the Ultimate Buy & Hold Portfolio beat the S&P 500 on both a general and risk adjusted basis, but had a lower risk-adjusted return than the UB&H versions including bonds.

To add this pie to your portfolio on M1 Finance, click this link and then click “Save to my account.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosure: I am long AVUV and AVDV in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

FNDC recently changed its index and its objective. Might want to revisit if it’s the right choice for Int’l Small Blend here still? I’m not saying it isn’t, I just don’t know.

Per Schwab’s site:

“Effective June 21, 2024, this fund changed its index and fund objective. The fund changed indexes from the Russell RAFI Developed ex US Small Company Index to the RAFI Fundamental High Liquidity Developed ex US Small Index.”

A high quality alternative to FNDC is DFIS by dimensional.

Thanks for this article John!

Would you consider comparing the all-equities “Paul Merriman 10 Fund Portfolio (UBH-100)” you mentioned with this overlapping combination:

(AVUS, RPV, IJR, AVUV, AVDV, SOXQ, FIDU, VLU, XCEM, FLIN).

Thanks for your lazy portfolio reviews and detailed analysis and comparisons. One thing I’ve been doing using Greens Gone Fishing Portfolio is following his advice about placing my tax-inefficient funds/etfs into tax-deferred accounts and remaining funds/ETFs in my taxable account. Where can one find guidance on this? I’m actually a bit disillusioned with the GFP lately and am thinking of going into a portfolio which takes advantage of value stocks and government bonds like the UB&H.

What’s your take/approach on spreading a portfolios assets across and taxable and tax-deferred accounts?

Definitely makes sense to allocate based on tax efficiency whenever possible.

Hi,

Do you have a comparison between your Ginger Ale portfolio and this portfolio? Do they seem to have the same CAGR, or am I wrong?

Haven’t compared them directly but I’ll see if I can run that for you.

Also interested in seeing this side by side

John,

The international portion of the UB&H portfolio is equal weighting the five international funds (e.g., 6% each to large blend, large value, small blend, small value, and emerging markets). This results in a 4:1 weighting of developed markets to emerging markets. Would you prefer this to be 1:1 by weighting each of the four developed markets funds at 3.75% and the emerging market fund at 15%?

Thanks

Newbie investor here. Looking at just the US equity portion, and back testing for the last 20 yrs using Vanguard etf’s, doesn’t investing in just the total market (VTI) beat/match this portfolio on pretty much all metrics? Back testing for the last 20 yrs using Vanguard funds (VTI, VTV, VB, VBR) it seems so, with the small/value tilt of the Merriman actually lowering performance (at least in the last few years)? Or am I missing something that makes this more complex portfolio somehow “better”?

Not sure. 20 years isn’t very long. As noted, Size and Value have suffered over the past decade. Don’t chase recent performance.

Thanks John. As you have said, the ideal portfolio varies from person to person. Maybe you could suggest or do an article on the top 3 choices for a retiree portfolio that minimizes drawdowns?

Thanks

Good idea. It would probably be one I mentioned at the end of this recent post on tail risk.

I am using the ultimate buy and hold portfolio and I would appreciate your advice. My large cap etf is MGV, and I am wondering if I should change it to VOOV because MGV is more mega cap than large cap.

Depends on whether you want mega cap value or large cap value.

I have become fascinated with the works of Paul Merriman. I really think this portfolio is onto something. I belive you agree, as your Ginger Ale and Value portfolios are heavily inspired by the UB&H. With as much as you pull from this portfolio, I would like to see you dig a bit deeper into what you believe works well and what needs adjustments, both weights and ETF choices. I’m not trying to be critical of your work, in contrast, I love coming here to read your articles. But for a website with “optimized” in the title, all you’ve done here is adjust the bond choice. Paul has also mentioned in a number of podcasts that those under 40 do not need bonds, but for those coming to your site, they may think otherwise.

Personally, I don’t feel comfortable holding 50/50 US/Intl. And from what I’ve gathered from reading around your site, you would likely use VOO/VEA/VWO instead of AVUS/AVDE/AVEM. You would also suggest 80/20 Developed/Emerging is too low for emerging, right? I think VXUS is at least 25%

I’ve posted ideas of my own portfolio designs, as you noted, which are what I believe “works well.” It wouldn’t make much sense for me to entirely rework the UB&H here – or any popular lazy portfolio I’ve discussed – in the name of “optimization” to simply transform it into one of mine. I also can’t know the future, so I usually can’t say a certain inclusion or exclusion is an objective improvement. Moreover, the name of the website doesn’t have to dictate a protocol for every single piece of content I publish.

I’ve noted many times that the rational accumulator should probably be 100% stocks, but that humans are unfortunately highly emotional and irrational, and succumb to many biases, so many should indeed be holding bonds based on their personal risk tolerance, which they’ll discover in a market crash or protracted bear market. If the young investor sells during a crash, they likely would have been better off with something like 60/40 from the start.

One thing I don’t understand about this portfolio is the allocation to REITs. Clearly Merriman is familiar with the research behind factor exposures, and since we believe, according to the latest research, that REITs aren’t a distinct asset class providing a diversification benefit, why is there still a dedicated overweighting of REITs? Has he explained this anywhere?

Really only one paper showing that, so it’s not widely accepted by any means. Swedroe also still advocates for the inclusion of REITs, and he literally wrote the book on factors. Ideas like this take time and replication before they’re adopted. Merriman also designed this portfolio before that paper came out.

With the new Avantis ETFs hitting the markets this week, what are your thoughts on the following as an update to the PM UB&H?

10% AVUS (Total US)

10% AVLV (US Large Value)

10% AVUV (US Small Value)

10% AVRE (US REIT)

10% AVDE (Total Developed Markets)

10% AVIV (Dev Markets Large Value)

10% AVDV (Dev Markets Small Value)

10% AVEM (Total Emerging Markets)

10% AVES (Emerging Markets Value)

10% DGS (Emerging Markets Small Dividend)

I mean, sure, if you wanted to go all in on Avantis funds.

Hi, John,

I’m enjoying your insights and thoughts on different portfolios.

I’m surprised that you seem so enamored of the Avantis ETFs, since they’re actively managed, and you’ve several times (maybe more) espoused your belief in Modern Portfolio Theory. For my personal funds I limit myself to indexed ETFs only, and wonder why you see additional value in going with actively managed ETFs. FWIW, these ETFs also have a very short history behind them, which also gives me concern.

Just a thought on the Lazy Portfolios in general. Most of these are designed to place high in returns, without regard for safety, i.e. most have no bonds or hedging components. It would be useful to us if the ones with bonds or hedging were indicated so we could view those as more realistic portfolios to model after.

Thanks, and keep up the good work!

Ron

Thanks, Ron.

Avantis funds are rules-based-active, not true “active.” “Passive” is largely a myth anyway; indexes are created by people, e.g. the S&P indexes constructed by committees.

No, “most” of the lazy portfolios are not “designed to place high in returns without regard for safety.” Most do indeed have “bonds or hedging components.” Many, like the 3-Fund, are a template anyway, which the investor is encouraged to adjust to their specific asset allocation.

I am doing a variation of Paul’s UB&H All-SCV portfolio. Using AVDV, AVEM, and AVUV. Avantis has submitted a filing with the SEC for some new offerings in September which includes an Emerging Markets Value etf (AVES), and not being from the US; using my tax advantaged accounts to invest in this strategy, my initial idea is to just continue holding AVEM until AVES becomes available. I know that AVEM tracks the broad EM index with some watered down factor applications. I expect good things from Avantis so I cannot wait for September.

https://mobile.twitter.com/etfhearsay/status/1407015072673714176?lang=en

https://www.sec.gov/Archives/edgar/data/1710607/000171060721000034/acetftavantis2021485.htm

Paul updates his portfolio every two years, but it’s a pretty safe bet if Avantis delivers on it’s new offerings that they will be included. Being in my later 20’s and knowing what I know about Avantis, I’m willing to give them the benefit of the doubt on these new offerings.

First, I’d like to hear your take on the new prospects.

Secondly, would you be interested in doing a review of Paul’s All-SCV portfolio?

AVUV 50%

AVDV 30%

AVEM 20%

From the SEC document, we can see that AVES is going to be an all-cap fund that focuses in on areas of profitability and value (as we have seen in other Avantis “value” funds).

Thanks for the comment, Spencer! Admittedly I haven’t looked into the new Avantis filings but I’ll try to get around to it, and to doing a write-up on Merriman’s All-SCV portfolio.

I forgot about this resource (of course it’s past data)

https://paulmerriman.com/wp-content/uploads/2021/02/Fine-Tuning-Tables-50-50-2020.pdf

Yes, please do a write up on the All-SCV portfolio. The one Spencer mentioned is the 50/50 international/US which I am also invested in.

Hey John,

I’m curious. Will you ever do an article discussing your own current portfolio holdings? Or the core portfolio strategy you personally have committed to? I find it interesting that you own five of the ten ETFs that make up this portfolio, so I’d be curious to see what you committed to and what led you to choose that strategy after researching so many others.

Hey Daniel, thanks for the comment. I think I will at some point, because multiple people have asked, though one could probably piece it together from the disclosures and comments around the site. In a nutshell, my taxable account is NTSX, I’ve got a bit of play money in the Hedgefundie Adventure in a Roth, a Traditional IRA in PSLDX, and in my “main” retirement account – the bulk of my portfolio – I use VOO and VWO as core holdings and then I tilt Small Cap Value and Value overall, with a dash of Utilities to diversify away from tech since I work in tech.

Daniel, finally got around to writing up my own portfolio.

M1 makes things simple to manage so this wouldn’t be as big of a deal if using their platform but are you aware of and have you looked into, the Simplified UB&H portfolio? A member from Bogleheads took this UB&H and simplified the stock side to just 4 funds instead of 8. Basically same risk and return as well. This is essentially what my portfolio has been for 10+ years now. You can check out the thread from Trev H on Bogleheads for details. Unfortunately, all his graphs are no longer showing up in the thread.

Haven’t heard of the Simplified Ultimate Buy and Hold portfolio, Kevin. Thanks for bringing it to my attention; I’ll check out that Bogleheads thread.

Here’s the extremely long thread started by Trev H on it: https://www.bogleheads.org/forum/viewtopic.php?t=38374

The stock side is basically condensed down to US LB (I just use S&P or TSM fund), US SV, ILV (I just use a total international fund), IS allocations, split equally.

This is very interesting and I like the principle behind it, although looking at the Bogleheads thread it’s from 2009 and so well predates easy access to a true Intl SCV fund. Implementing this now, going LCB/SCV/ILCV/ISCV seems like an easy choice (and I believe Swedroe has said elsewhere that the Large Value premium may be stronger overseas than here in the US).

This also makes it really easy to split the international component into equal parts Developed and Emerging, which we could do with DFIV/AVDV/VWO/AVES (so basically Intl Dev LV/Intl Dev SV/Emerging Blend/Emerging Value).

John,

Thanks for writing this article. I have heard some podcasts about him and I like your strategies to change out the bond all together to Long Term Treasury. This can decrease the US market correlation and also potentially boost return. I did a little bit different from you that I just used his 60/40 but only changed out the bond to long term treasury. Surprisingly, I get a very close return to your 80/20 portfolio with less standard deviation. If you like, you can test that and I am an amateur and maybe I did something wrong, but I would like to bring this idea up.

Thanks,

Grace

Grace,

Thanks for experimenting and commenting. I like to adjust bond allocation based on time horizon and risk tolerance. I personally don’t plan to have 40% bonds until retirement, at which point I shouldn’t be entirely in long-term bonds, so that’s my take on it. For a young investor with a long time horizon, going all in on long-term bonds should be fine. I explored bond allocation and bond duration in detail in my post on the classic 60/40 Portfolio if you’re curious in checking that out.