With interest rates at all-time lows, some brokers are passing savings on to their retail investor base in the form of lower margin rates. This is great, allowing you to more cheaply leverage your portfolio. I won't bore you with an unnecessary primer on what margin is; if you landed here, you likely already know. If you're unfamiliar with what margin is, check out this post. For everyone else, let's get right into a comparison of the investing brokers with the lowest margin rates for 2024.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Lowest Margin Rates Brokers Comparison Chart

Below is a chart comparing the margin rates of all the major brokers, assuming a margin loan of $100,000. Some brokers offer tiered rates that decrease slightly as your loan balance increases. I chose to compare $100,000 because that was the median tier in most of the rate tables of these brokers. Rates were taken directly from the broker's website. Rates may vary.

| Broker | Margin Rate |

|---|---|

| Interactive Brokers Lite | 7.83% |

| Interactive Brokers Pro | 6.83% |

| M1 Finance | 7.25% |

| Etrade | 12.70% |

| Fidelity | 12.075% |

| Schwab | 12.075% |

| Robinhood | 6.55% |

| Vanguard | 12.25% |

| TastyWorks | 9.50% |

| Ally Invest | 10.75% |

So basically we're down to M1 Finance, Interactive Brokers, and Robinhood for the lowest margin rates. All offer commission-free investing. Let's compare some of the nuances.

First, let's talk about Interactive Brokers. They're famous for having some of the best margin rates around. The minimum invested balance to access margin at Interactive Brokers is $2,000. The minimum for M1 Finance is also $2,000.

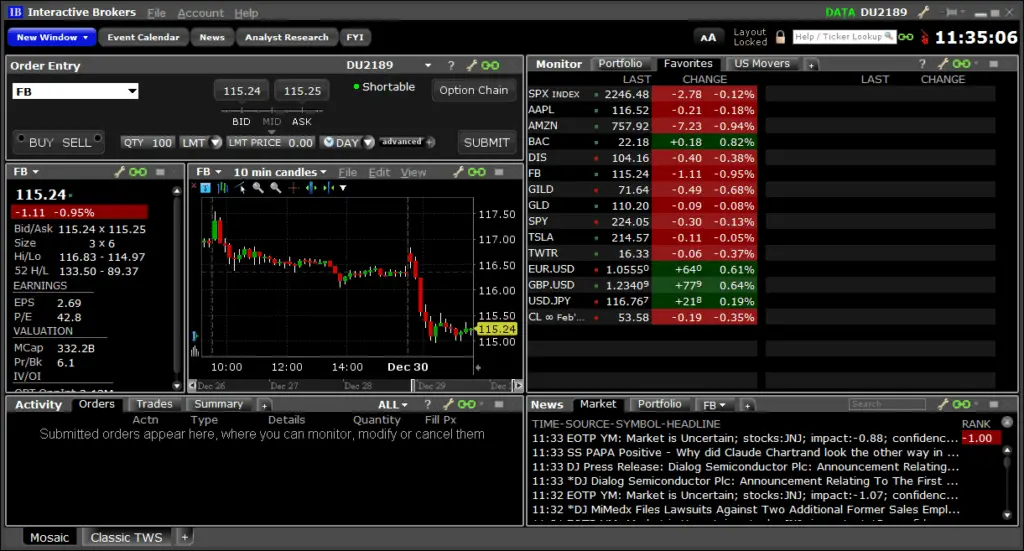

Unfortunately, the Interactive Brokers interface is pretty unintuitive and confusing, especially for a beginner investor. Interactive Brokers is definitely only suitable for sophisticated, seasoned investors and traders. Here's their interface:

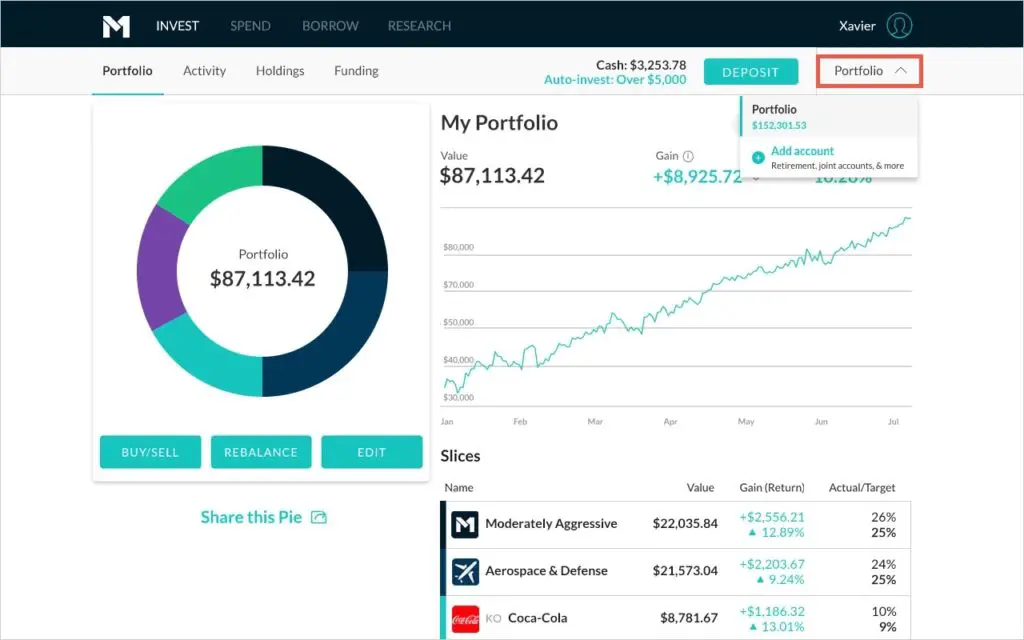

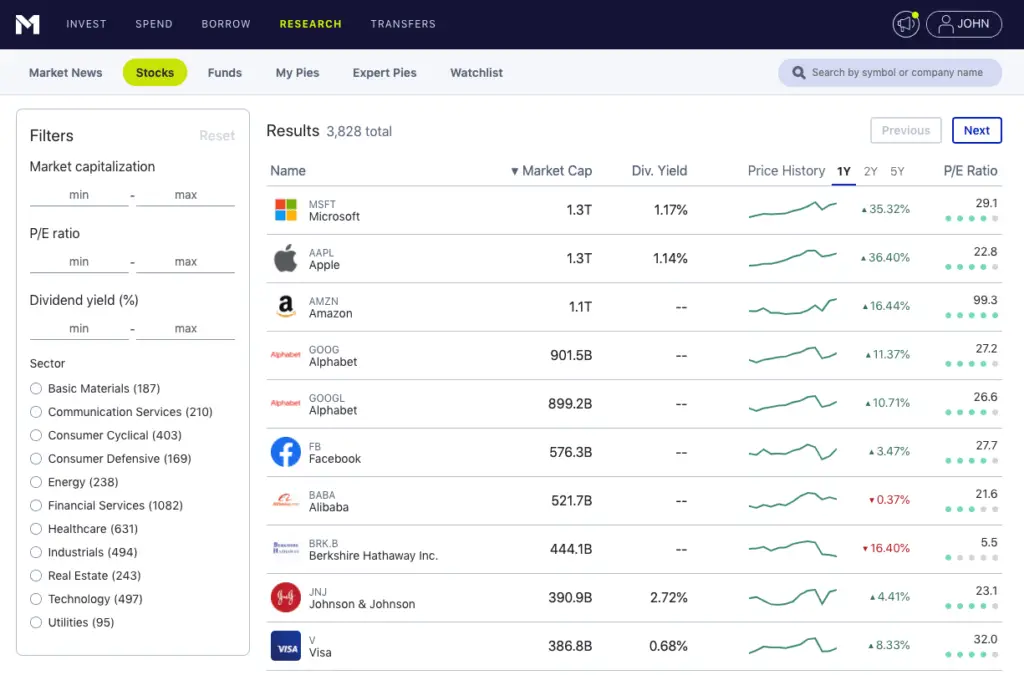

The interface for M1 Finance, on the other hand, is extremely simple and intuitive:

IB's customer service is also notoriously pretty awful. In fairness, if you're an experienced trader, you may never actually need to contact Support.

Granted, if you're an active day trader and want access to futures, options, and currencies, go with Interactive Brokers over M1.

Now let's briefly address Robinhood. In short, while they often have one of the cheapest margin rates around, I think the platform may not even have a future after recent events.

Robinhood experienced outages on 3 days during one week in March 2020, which they stated was caused by “stress on our infrastructure—which struggled with unprecedented load.” One of these outages lasted an entire trading day. This was obviously very frustrating and concerning for users, especially considering these were high-volume, high-volatility days in the stock market.

Robinhood users have since filed a class-action lawsuit against the platform, alleging that “Robinhood had a duty to provide a system and platform ‘robust enough’ to handle that trading volume and have a backup system to handle outages.”

In December 2020, the SEC fined Robinhood $65 million for misleading users about its selling of order flow between 2015 and 2018, meaning users got worse trade execution prices than the platform claimed. Robinhood maintains that these were “historical practices that do not reflect Robinhood today.”

In the same week, the Massachusetts Securities Division filed a lawsuit against Robinhood, alleging that the broker uses “gaming strategies to manipulate customers” to execute more trades in order to boost fees, thereby taking advantage of inexperienced investors.

There are also many user complaints such as these of the site being “frozen,” orders not going through, inability to login, etc.

One could argue that these events may cause Robinhood to improve their infrastructure going forward to make sure this doesn't happen again in the future. On the other hand, it is concerning considering other brokers did not experience these outages and issues during that same time period. I’ve already seen many users running from Robinhood in droves and finding alternatives in platforms like Webull, M1 Finance, etc. It will be interesting to see how things go going forward for Robinhood.

Perhaps most importantly, Robinhood users have been fleeing en masse after the broker's recent stance on temporarily blocking users from buying stocks like GameStop ($GME) and AMC Entertainment ($AMC) during the massive short squeeze event. As of February 1, 2021, over 33 federal lawsuits have been filed against the platform across the country, citing securities trading and consumer protection violations, which add insult to injury after Robinhood hid the fact that it sold order flow and gave users worse trade execution prices.

The name of the platform now seems ironic, considering Robinhood seems to be placating hedge funds and Wall Street hotshots – at the expense of retail investors – at every turn.

I think M1 is probably the best of these for the average investor.

Customer service from M1 started off slow when the platform first launched but M1 has famously recently hired a team of new staff members to man the phone lines. Interactive Brokers also doesn't provide access to an integrable checking account like you can with M1 Finance via M1 Spend.

Margin loans can be used for whatever you want – refinancing higher-interest debt, major purchases, unexpected expenses, etc. – it's essentially just a low-interest collateralized loan.

Remember that margin (in this case, via M1 Borrow) is an additional risk, including the risk of losing more than you invest. M1 Borrow is available for margin accounts with $2,000 or more in equity. M1 Borrow is not available for retirement or custodial accounts. Rates may vary.

M1 also offers fractional shares, zero transaction fees, zero account fees, and dynamic rebalancing. I wrote up a comprehensive review of it here. I also discussed M1's margin loan product – called M1 Borrow – in a separate post here.

What Is Margin?

The term margin simply refers to money borrowed against your portfolio, where your investments are collateral for the loan, usually to enhance one's exposure. “Buying on margin” means using that margin loan to buy more securities in your investment portfolio, thereby leveraging it.

Margin is similar to a HELOC. Just as a bank can lend you money if you have equity in your home, your brokerage firm can lend you money against the value of your investment portfolio.

Most require a minimum invested balance to be able to access margin. One must also pay periodic interest payments based on the margin rate, the interest rate of the margin loan.. Margin obviously becomes advantageous when your rate of return is higher than the interest on the margin loan.

If the value of your investments falls below a specified “maintenance requirement,” you'll incur what's called a margin call, where the broker demands funds to bring the account back to the maintenance level. This requires either depositing new cash or selling your investments. If you cannot meet the requirement, the broker will automatically close your positions to bring your account to the maintenance level.

Advantages of Margin

Margin allows you to enhance your investment exposure, increasing your position. This is great if the market is going up, but can be bad if the market tanks. If you have an account in which you deposit $10,000 and your broker allows you to borrow $10,000, you now have $20,000 in buying power and can therefore double your exposure to your investments.

Margin can also be a source of credit with no credit check and no repayment schedule. You can borrow against your portfolio and use the margin loan to cover emergency expenses. This allows you to avoid selling securities in your account and incurring capital gains taxes. Margin loans are generally cheaper than other forms of credit like a bank loan or credit card.

Let's look at an example.

Suppose you invest $10,000 of your own money and your investment increases in value by 50% to $15,000, a gain of $5,000. Had you invested with margin, borrowing an additional $10,000 for a position of $20,000, your investment would be worth $30,000 after the 50% gain, doubling your return.

Now let's make it a more complete example by including the margin interest at an 8% interest rate. With your $10,000 margin loan above, your interest on the loan is $800.

With an account with $10,000 and a margin loan of $10,000, your portfolio is said to be 2x leveraged – your buying power is 2x the amount of your initial capital. Unlike leveraged ETF products, with margin loans, your leverage ratio changes based on the performance of your investments. Because of this, the amount you can borrow changes daily. You can borrow more if your investments increase in value, and you can borrow less if your investments decrease in value.

Margin Risks

Hopefully at this point you realize that if you borrow on margin, you can lose more than the amount deposited in your investment account. Suppose in the previous example the investment had instead dropped by 75%. Your $20,000 investment with margin would be worth $5,000, lower than your initial collateral. This is when a margin call occurs where you have to cover the deficiency. This simplistic example doesn't even include the interest on the margin loan – $800 (8% of $10,000). In short, margin/leverage can magnify your gains but can also magnify your losses.

Most firms have a maintenance requirement around 30%, meaning you must have at least 30% in actual equity of the value of your account. Maintenance requirements from your broker may change without written notice. Furthermore, when you incur a margin call, brokers can sell your securities without notice if you are unable to replenish the discrepancy with newly deposited cash. The broker will likely notify you, but they are not required to. In such a case, you're unable to choose which specific securities are liquidated. You are also not entitled to an extension of time on a margin call.

It's important to diversify your investments when investing with margin, so that you're not concentrating your risk and increasing your chances of incurring a margin call, also known as a maintenance call. That is, don't use margin to buy a single stock. Furthermore, if margin investing doesn't fit your particular risk tolerance, don't entertain the idea to begin with.

You get to choose the amount you borrow. Buying 25% on margin (33% borrowed) is much more sensible, for example, than buying 50% on margin (100% borrowed). The more money you borrow, the more risk you take on. This is why diversification is increasingly important with margin loans as your amount borrowed increases. A higher amount borrowed also increases your chances of a margin call. You can be responsible with margin by only borrowing a small amount, paying margin interest regularly, and monitoring your investments.

Note that certain securities cannot be bought on margin, such as penny stocks. Brokers may also exclude certain high-risk securities at their discretion. Also note that margin loans cannot be used in retirement or custodial accounts.

Should You Use Margin?

Again, whether or not you employ margin/leverage comes down to your investing strategy and risk tolerance. You must use a sufficiently-diversified portfolio if you are going to use margin/leverage. Carefully weigh the pros and cons and understand how margin works before diving in.

Assess what leverage ratio will allow you to sleep easily at night. Consider starting low and slow and work your way up as your investments [hopefully] appreciate in value.

Alternatively, if you need access to short-term emergency credit for emergencies, margin is a perfectly suitable alternative to credit cards or bank loans and will likely have a lower interest rate. Check your broker's margin rate for comparison.

Disclosure: Again, remember that margin is an additional risk, including the risk of losing more than you invest. Margin is not available for retirement or custodial accounts. Rates may vary.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hey John,

Thanks for the detailed explanation.

I’m new to the margin loan world and I have a question:

How do you payback the margin loan? Let’s assume the market keeps doing well and the value of the stocks keep rising plus the stocks portfolio increases (with more vested stocks) overtime. Since, the goal is to “NOT” sell stocks; how do you payback the margin loan?

Thanks again.

If the value of the portfolio increases and you don’t borrow more, your loan as a % is now less. I suppose you could gradually pay it down using dividends you receive or from cash on hand. Or just sell shares as needed, particularly when the market has a great year. Money is fungible. And we’re investing to fund future consumption, for which we have to “sell stocks” anyway. Having a rule not to sell seems silly to me.

Hi John,

I’m also new to margin like Femi. I was was also wondering how to pay the margin loan back. Obviously, when you sell your investment for a gain. They will take their share out.

How long can you stay with the margin loan? Let say you have a stock like Apple that you think will keep going up and you want to just hold for a couple years? Can you buy that your margin loan? Or do you sell the amount that was borrowed on margin and than hold? Also, Everyone is not right with every trade. So once your wrong on a trade like Pelaton. how long do you have to fix would be margin call with out them selling your Apple?

Thanks

They don’t “take their share out” when you sell for a gain. Margin is just a loan. As long as you’re making the required interest payments and your equity stays above maintenance, you can keep it. If the collateral drops in value, you may get margin called. Yes, you can borrow and buy a stock. You’d need to read up on the broker’s maintenance requirements.

How good Is M1 for day/ swing trading? The website says it’s geared for long-term investors, and quite frankly I’ll stick with TD Ameritrade for that. I’m looking for low margin, YOLO ‘betting’ with a separate account where my long holdings aren’t involved. Basically a short-window trading app.

Thanks! Great article!

Hey Brian, M1 would not be a great choice for day trading.

Thank you for this very useful and well-written page, and thank you for being up front in your disclosure.

I have been with one of the brokerages in your comparison chart since the ’90’s and I love them to pieces, but they’re charging me 8% margin interest. I am going to stick with them for my non-margined holdings and am shopping around for a lower rate on my margined holdings. Robinhood was never under consideration — too much baggage and too many lawsuits — and too many red flags with Interactive Brokers. I am giving M1 serious consideration thanks to this article.

Thanks again.

Thanks, Chris. Glad you liked it. Agreed on RH and IB. That’s why I’m with M1.