Get your portfolio off the ground on the right foot at a young age with passive, buy-and-hold index investing. Here we'll look at the best index funds for young investors for 2025.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here's the list:

- VOO – Vanguard S&P 500 ETF

- ITOT – iShares Core S&P Total U.S. Stock Market ETF

- VT – Vanguard Total World Stock ETF

- IXUS – iShares Core MSCI Total International Stock ETF

- MGC – Vanguard Mega Cap ETF

- VIG – Vanguard Dividend Appreciation ETF

- NTSX – WisdomTree 90/60 U.S. Balanced Fund

- AGG – iShares Core U.S. Aggregate Bond ETF

- GOVT – iShares U.S. Treasury Bond ETF

- FSKAX – Fidelity Total Market Index Fund

- FTIHX – Fidelity Total International Index Fund

- VTWAX – Vanguard Total World Stock Index Fund Admiral Shares

- VBTLX – Vanguard Total Bond Market Index Fund Admiral Shares

Contents

Introduction – Index Funds

John Bogle, founder of Vanguard and considered the father of index investing, said “invest early and often.” Many don't realize how powerful that statement and approach is until it's too late. One of the main regrets I have in life is not investing earlier, and not investing smarter when I did start.

For far too long I erroneously believed that I was part of the 1% who could trade stocks in the short-term and beat the market. Years later I finally accepted the truth that stock picking doesn't beat the market for the vast majority of investors, especially over long investing horizons.

Thankfully, if you've arrived here, you probably already know that fact. Investing in broad indexes drastically lowers portfolio volatility and risk, especially when incorporating multiple asset types. I delved into the nature of index funds and index investing as a strategy in more detail here if you're interested. Below we'll explore some of the best index funds for young investors for long-term growth.

The Best Index Funds for Young Investors

Index funds come in the form of mutual funds and ETFs. We'll explore a few of each here. ETFs should be available at any major broker. Mutual funds are considered an “older” product and are likely only available from the larger traditional brokers like Vanguard, Schwab, etc.

The only major differences between ETFs and mutual funds nowadays are that mutual funds may have minimum investment requirements whereas ETFs do not, and the buying and selling of ETFs allow for price control of entry and exit whereas mutual funds simply trade at their end-of-day price.

ETFs for Young Investors

Here's a list of the best ETFs for young investors.

VOO – Vanguard S&P 500 ETF

VOO is Vanguard's ETF to track the S&P 500 index, comprised of 500 of the largest companies in the United States. The S&P 500 index is a proxy for what is referred to as “the market.” VOO has an expense ratio of 0.03%.

ITOT – iShares Core S&P Total U.S. Stock Market ETF

If you also want some exposure to small- and mid-cap stocks, which have outperformed large-caps historically, this total market index fund from iShares is great. The fund holds over 3,500 stocks. This ETF seeks to track the S&P Total Market Index and has an expense ratio of 0.03%.

VT – Vanguard Total World Stock ETF

Prefer to invest globally? Vanguard's Total World Stock ETF is roughly half U.S. stocks and half foreign stocks. This ETF seeks to track the FTSE Global All Cap Index, delivering global diversification with equities. The fund contains over 8,500 stocks and has an expense ratio of 0.08%.

IXUS – iShares Core MSCI Total International Stock ETF

If you live in the U.S. and have home country bias and want to dial in your ex-US stock allocation manually instead of using the global market weight with VT, you can do so with IXUS, the iShares Core MSCI Total International Stock ETF, which seeks to track the MSCI ACWI ex USA IMI Index. In other words, this ETF is composed of all stocks outside the United States. One might opt to build their 100% stocks portfolio using 80% ITOT and 20% IXUS, for example. IXUS has an expense ratio of 0.09%.

MGC – Vanguard Mega Cap ETF

If you only want the largest household name companies in your portfolio but still want global diversification, Vanguard's Mega Cap ETF holds roughly 250 of those. Think Apple, Amazon, Google, Disney, Johnson & Johnson, etc. In theory, these large companies should have lower volatility than smaller companies, meaning these stocks are usually more “stable.”

VIG – Vanguard Dividend Appreciation ETF

Want a dividend focus in your portfolio? This ETF tracks the NASDAQ US Dividend Achievers Select Index, formerly known as the Dividend Achievers Select Index, which is comprised of companies that have increased their dividend payment for 10 consecutive years. VIG has an expense ratio of 0.06%.

NTSX – WisdomTree 90/60 U.S. Balanced Fund

A special mention on this list is NTSX. I explored it in more detail here. This fund from WisdomTree employs what's known as leverage, a way to enhance market exposure without additional capital outlay. Leverage of “2x” or “200%,” for example, would mean your $10,000 investment gets you $20,000 of market exposure. This can obviously magnify both gains and losses.

I'm obliged to suggest reading up on the potential pitfalls of using leverage before blindly buying in, but I think this fund in particular is a comparatively “conservative” use of leverage. Moreover, young investors can afford to be more aggressive and employ leverage early in their investing horizon. NTSX was also conveniently built with tax-efficiency in mind, so it's suitable for a taxable account. I hold it in my own taxable brokerage account.

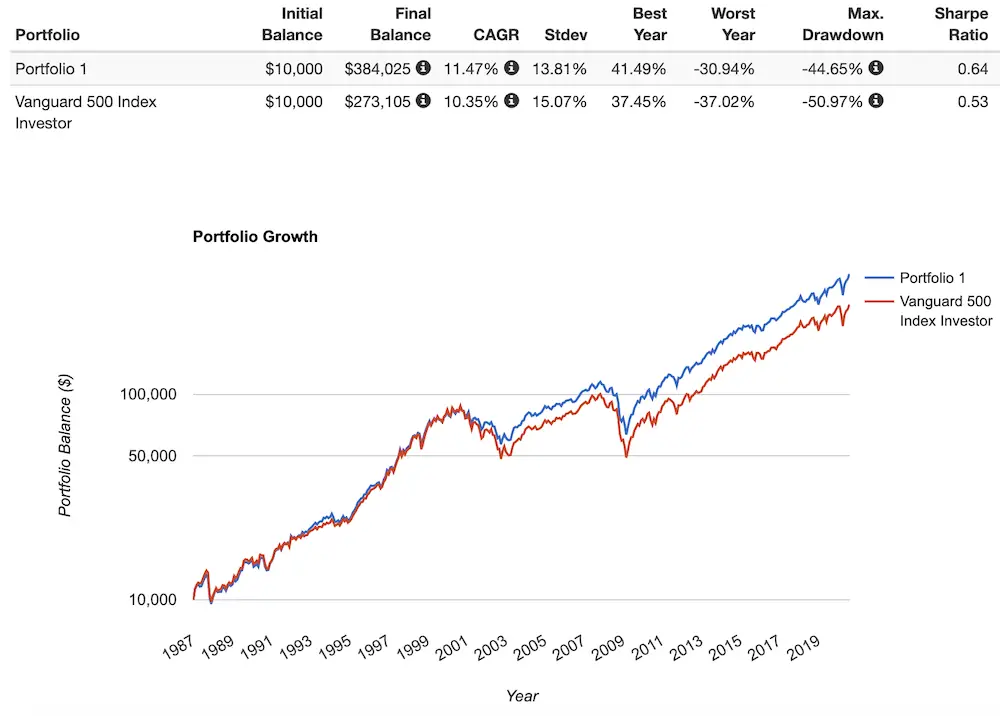

This fund essentially takes a traditional 60/40 stocks/bonds portfolio and applies 1.5x leverage, achieving 90/60 exposure. It does so by holding 90% S&P 500 index stocks and 10% 6x bond futures. You can read the fund's prospectus for more details. Theoretically, this fund should deliver close to or above market returns with lower volatility and smaller drawdownsHere's how this strategy would have performed historically versus the S&P 500:

AGG – iShares Core U.S. Aggregate Bond ETF

If you have a low risk tolerance or a short time horizon, you'll probably want some bonds in your portfolio. Bonds and stocks are uncorrelated, meaning when stocks go down, bonds tend to go up, and vice versa. This relationship tends to be conveniently amplified during periods of market turmoil. Because of this, bonds can drastically lower a portfolio's volatility and risk. A popular low-risk asset allocation is 60% stocks and 40% bonds, called the 60/40 Portfolio.

The iShares Core U.S. Aggregate Bond ETF is a good choice for a single, simple bond holding, providing broad diversification across the entire U.S. bond market. This ETF seeks to replicate a market-weighted U.S. bond index, containing both government/treasury and corporate bonds. With AGG, young investors don't have to worry about deciding on a specific bond type or duration. At the time of writing, AGG has an expense ratio of 0.04%.

GOVT – iShares U.S. Treasury Bond ETF

If you're like me, you might prefer treasury bonds over corporate bonds, since they are a superior hedge for stocks. Moreover, if you're investing in a taxable brokerage account, interest from treasury bonds is tax-free at state and local levels. The iShares U.S. Treasury Bond ETF seeks to track the ICE U.S. Treasury Core Bond Index, a market-weighted index for U.S. treasury bonds. Think of this fund as AGG above minus corporate bonds. This fund has an expense ratio of 0.15%.

Mutual Funds for Young Investors

Prefer mutual funds? Here are a few of those. Note that these mutual funds may have transaction fees associated if you buy them outside their provider, e.g. buying a Fidelity mutual fund in your Vanguard account.

FSKAX – Fidelity Total Market Index Fund

Fidelity offers a great low-cost mutual fund for the total U.S. stock market in the form of FSKAX with an extremely low 0.015% expense ratio.

FTIHX – Fidelity Total International Index Fund

Fidelity has a total international (ex-US) stock market mutual fund as well. FTIHX has an expense ratio of 0.06%.

VTWAX – Vanguard Total World Stock Index Fund Admiral Shares

If you'd prefer to keep it even simpler and just use a total world stock market fund, a good option comes from Vanguard as VTWAX. This is essentially the mutual fund equivalent of the VT ETF mentioned above. The fund has an expense ratio of 0.10%.

VBTLX – Vanguard Total Bond Market Index Fund Admiral Shares

Similarly, Vanguard offers a nice, low-cost option for the total U.S. investment-grade bond market. VBTLX has an expense ratio of 0.05% and an average duration of about 7 years.

Where to Buy These Index Funds for Young Investors

Again, most of these index funds should be available at any major broker. My choice is M1 Finance. It has zero transaction fees and offers fractional shares, dynamic rebalancing, and a modern, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Disclosures: I am long VOO and NTSX.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

what would be your recommendation on how to allocated with these funds for a new 25 year old investor? thank you.

I’m about 19 years from retirement and invested in FSKAX and FTIHX. Do any of the lazy portfolios add mid cap and small caps on top of an existing total US market fund? I’d like to add a bit more risk/opportunity for growth to mine, but don’t want to rebalance to a different fund entirely. Looking for percentage ideas to include FSMDX and FSSNX. Maybe…..

– Bonds 2% – Yes, I know this is very aggressive, given I’m early 40’s, but a touch behind.. I’m adding a percent every year.

– FTIHX 35%

– FSKAX 55%

– FSMDX 6%

– FSSNX 2%

Yes, some lazy portfolios do tilt with small caps. I don’t know what those Fidelity mutual fund tickers are.