The Gone Fishin' Portfolio from Alexander Green is composed of 10 different assets. Here we'll check out its components, historical performance, my review, proposed modifications, and suggested ETFs for its implementation in 2025.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

Who Is Alexander Green?

Alexander Green is the designer of the Gone Fishin' Portfolio. He is the Chief Investment Strategist of The Oxford Club, “a private, international network of trustworthy and knowledgeable investors and entrepreneurs.” From what I can gather, essentially it's a newsletter. That's not a bad thing; apparently it's ranked pretty highly among investing subscriptions.

In the past, Green has worked as an investment advisor, research analyst, and portfolio manager. He has written several books:

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy…and Get on With Your Life

- Beyond Wealth: The Road Map to a Rich Life

- An Embarrassment of Riches: Tapping Into the World's Greatest Legacy of Wealth

- The Secret of Shelter Island: Money and What Matters

What Is the Gone Fishin' Portfolio?

The Gone Fishin' Portfolio is a diversified mix of 10 assets. It gets its name from the idea that you can go fishing with all the time you save by using a lazy portfolio and not having to monitor, manage, or change it.

Rather than guessing which assets will outperform during which years, Green advocates for diversifying broadly across them to reduce portfolio risk and drawdowns, similar to the idea behind the famous All Weather Portfolio. I can get behind that.

Green suggests that the portfolio is “breathtakingly simple” in that the investor only needs to set it up and then rebalance it once a year. I can definitely think of simpler portfolios, like the 3 Fund Portfolio, but it is indeed still simple compared to active management.

The assets and the allocations thereof for the Gone Fishin' Portfolio draw on the ideas of Nobel laureate Harry Markowitz, considered the father of Modern Portfolio Theory, who showed you can mathematically maximize risk-adjusted return pretty easily, at least in hindsight, by calculating the optimal asset allocation along what's called the Efficient Frontier – basically, diversifying across different, uncorrelated assets to reduce risk where it makes sense without sacrificing too much return in doing so. In Green's words, “it’s breaking down your portfolio into different baskets, or classes of investments, to maximize returns and minimize risk. As the cliche goes, ‘Don’t put all your eggs into one basket.'”

By diversifying across uncorrelated assets, we mean holding different assets that will perform well at different times. For example, when stocks zig, bonds tend to zag. Those 2 assets are uncorrelated. Holding both provides a smoother ride through choppy waters, reducing portfolio volatility (variability of return) and risk. We can extend the concept to more assets – real estate, metals, etc. – which is what Green did in designing the Gone Fishin' Portfolio. I delved into the details of diversification in a separate post here.

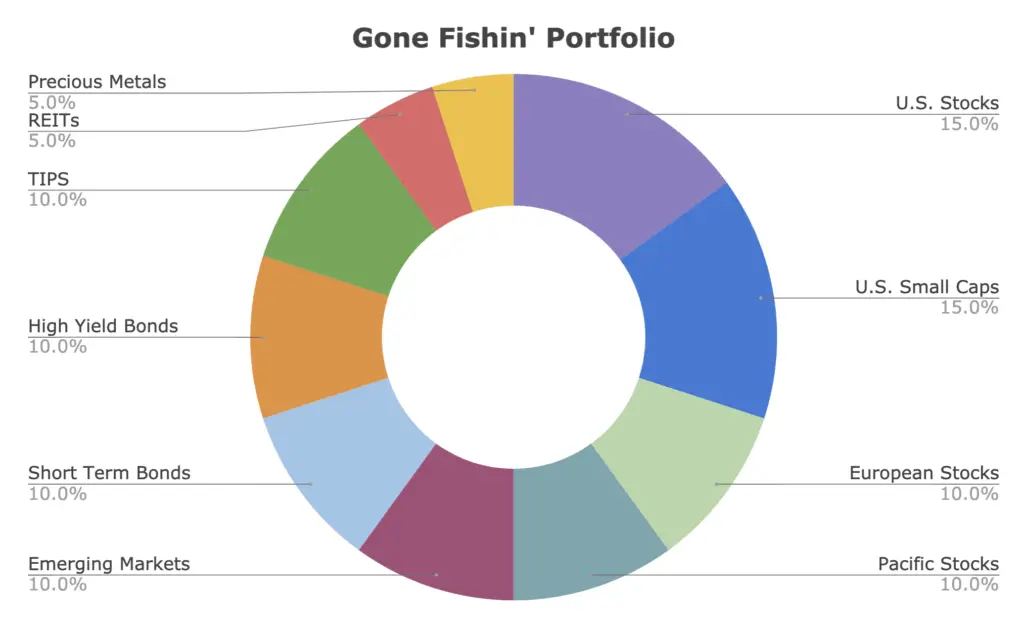

The allocations are as follows:

- 15% U.S. Stocks

- 15% U.S. Small Cap Stocks

- 10% European Stocks

- 10% Pacific Stocks

- 10% Emerging Markets Stocks

- 10% Short-Term Investment-Grade Bonds

- 10% High-Yield Corporate Bonds

- 10% TIPS (Treasury Inflation-Protected Securities)

- 5% REITs

- 5% Precious Metals

Gone Fishin' Portfolio Performance vs. the S&P 500

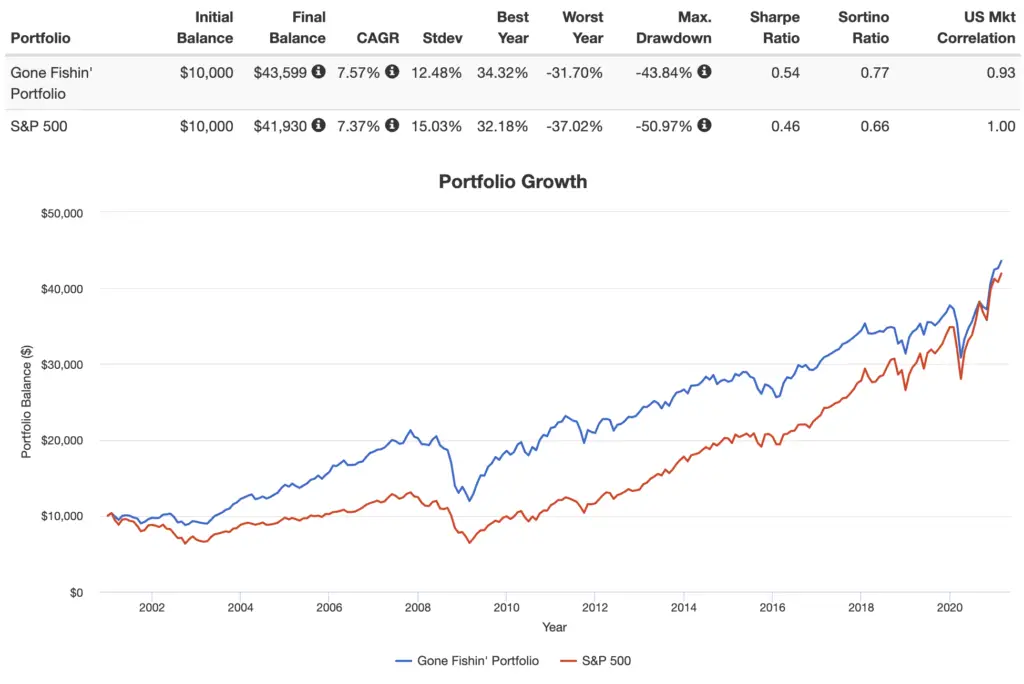

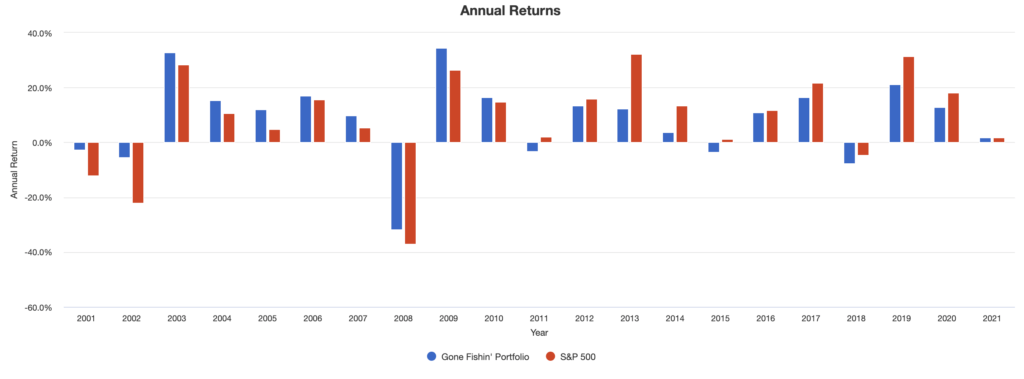

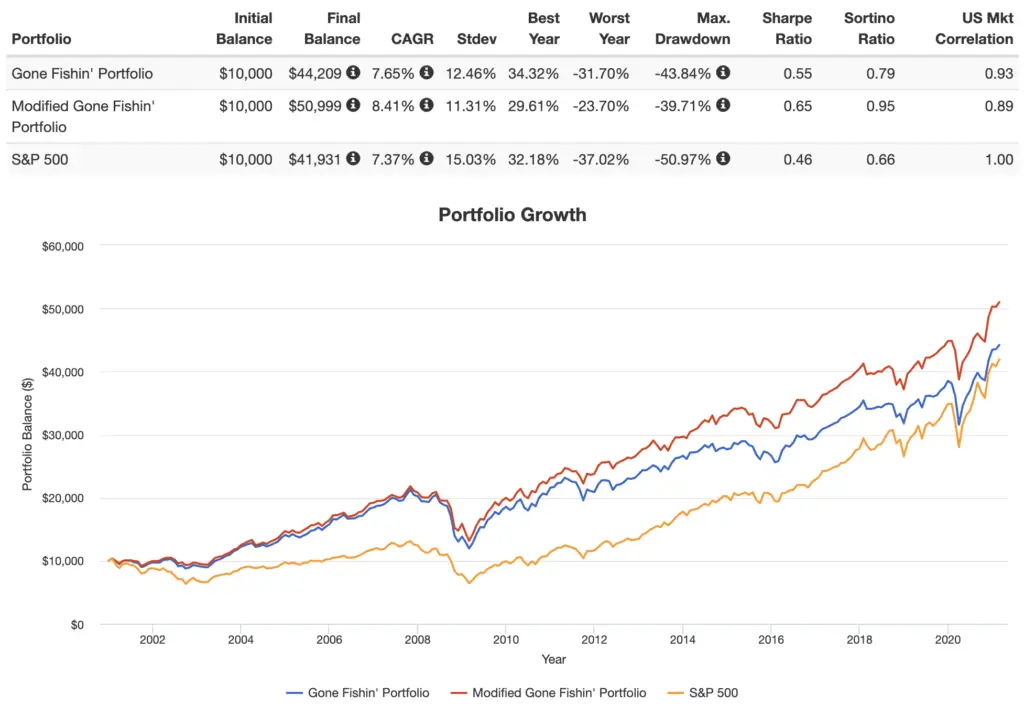

Going back to 2001 when TIPS data starts and looking through 2020, the performances of the Gone Fishin' Portfolio and the S&P 500 in terms of real return have been very close:

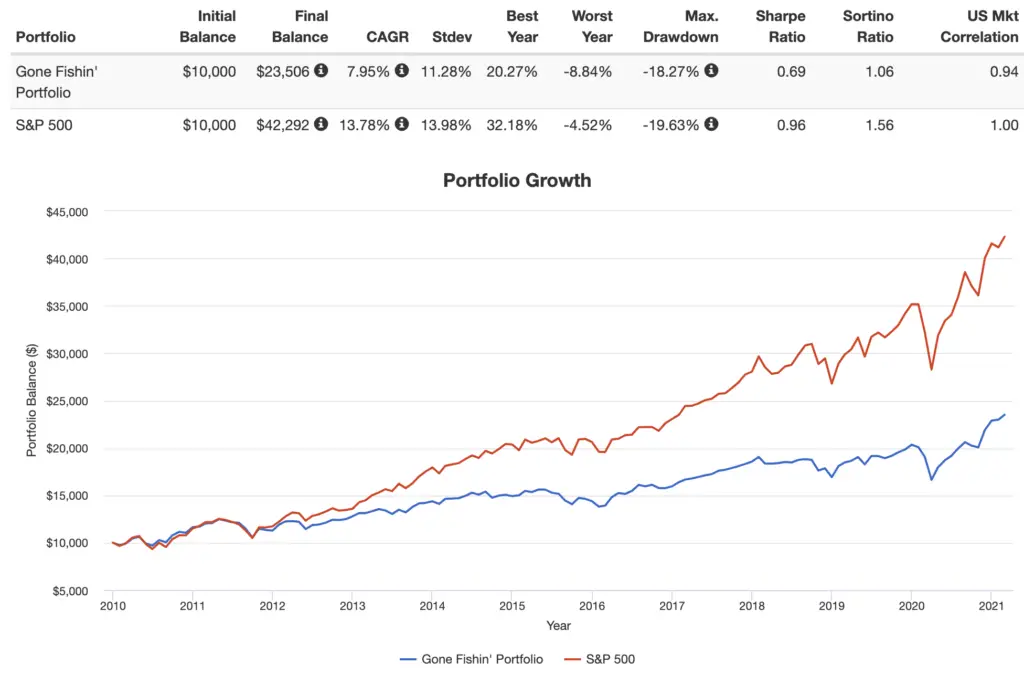

But if we look at the last decade, we see a very different story:

Green has claimed multiple times that “the portfolio has beaten the S&P 500 every year.” I don't know what linguistic sleight of hand he may be trying to pull or what metric he's talking about, because that is demonstrably untrue, even on a risk-adjusted basis:

Moreover, Green also claims that by investing in the Gone Fishin' Portfolio, we're “taking much less risk than being fully invested in stocks.” I wouldn't say it's “much less” risk. We can see that the volatility and drawdown metrics of the GFP compared to the S&P 500 are not very different. Those differences may be – and probably should be – negligible to a long-term investor. A true risk-averse investor would seek something like the All Weather Portfolio that does deliver on the promise of appreciably lower volatility and risk compared to 100% stocks.

My Review of the Gone Fishin' Portfolio

I got a bit long-winded, so I broke this up into sections:

The Good

- I'm a fan of lazy portfolios and diversification, especially for risk-averse investors.

- I love the healthy allocation to ex-US international stocks; the vast majority of U.S. retail investors don't have enough international exposure in equities because they irrationally fear them and/or think they'll drag down returns.

- I also like the overweighting of Emerging Markets relative to their global market weight and the inclusion of TIPS, two tactics that many lazy portfolios overlook. Ideally, I'd overweight Emerging Markets even further, as they have a reliably lower correlation to the U.S. – and are thus a superior diversifier – compared to Developed Markets.

- I like the purposeful overweighting of U.S. small caps, but it's suboptimal; more on that in a sec.

The Not So Good

Let me preface all my “not so good” comments by saying I have not read Green's book. After seeing the portfolio, I honestly don't think I want to. But in total fairness to him, perhaps he lays out his reasons in the book for the specific selection of assets and maybe those reasons are things I haven't thought of. That said, I do everything by the numbers, the data, and the evidence, and there's no room for subjectivity in those, so strap in.

Regarding point number 4 above, we know that it seems to be the case that the Size premium only applies to small cap value stocks with strong profitability and that we should probably avoid the “black hole” that is small cap growth stocks to effectively “control your junk.” In other words, small cap growth stocks don't tend to pay a risk premium. The Gone Fishin' Portfolio, by using a broad small cap index, is exposed for about 7.5% to small cap growth stocks. I'd rather see that 15% allocation go entirely to U.S. small cap value to capture the Size premium more effectively, as well as more of the expected Value premium and a slightly better diversification benefit.

Extending that argument, using a fund like VIOV or AVUV for U.S. small cap value that happens to screen for strong financials would also conveniently provide some exposure to Profitability, thus further diversifying the portfolio's factor exposure, and diversification is supposed to be supremely important here. Moreover, if we're overweighting small caps in the U.S., why not also do so abroad? To be fair, international small cap value products may not have been as ubiquitous when Green first designed this portfolio.

We know that Green knows about the Size premium and that consequently, a statistically solid bet is to overweight small caps, which is the justification for their conclusion, so then why not follow that bet to its logical conclusion and only use small cap value? If we're citing and utilizing Markowitz, Efficient Frontiers, risk-adjusted returns, etc., why not also utilize the vast wealth of research produced by some other Nobel laureates named Fama and French? If Green knew about the former, he had to also know about the latter. Green published the Gone Fishin' Portfolio in 2010. The Fama French 3 Factor Model was published in the early 1990's. Perhaps it's because Green has explicitly stated that he doesn't believe in the Efficient Market Hypothesis, so he may be throwing the baby out with the bathwater.

Next, and this is admittedly a minor grievance, I see no reason for the segmentation of Pacific and European stocks if we're holding them in equal weights. Cheaper, more liquid funds abound for ex-US Developed Markets, which are roughly half Pacific stocks and half European stocks. Green always mentions the “simplicity” of the Gone Fishin' Portfolio when discussing it. This seems like an obvious example of unnecessary complexity and increased costs.

The Weird and the Ugly

Then we get to the fixed income allocation: 1/3 short-term investment-grade bonds, 1/3 high-yield corporate bonds, and 1/3 TIPS. As I've said, I like the TIPS position. But overall, by my calculation, the average effective maturity of the fixed income allocation is about 5 years. If this is meant to be a long-term portfolio, why is the fixed income duration so short? At the very least, I'd want to replace the short-term bonds – considered a cash equivalent – with intermediate term bonds, but truthfully I'd likely go further and use long bonds to roughly match the effective bond duration to my time horizon, which is much greater than 5 years.

Moreover, the greater volatility of longer bonds as a flight-to-safety asset is better able to counteract the downward movement of stocks, as I've shown before. Again, Green tells us diversification is the primary concern. Then we should want to better diversify the portfolio's risk exposure. More volatile assets make better diversifiers. With such a short effective duration on the fixed income side, roughly 90% of the portfolio's risk is still being contributed by equities.

Arguably more importantly, we know that nominal treasury bonds are an objectively superior diversifier to hold alongside stocks compared to corporate bonds. Duration aside, using treasuries instead of the broader investment-grade bond landscape seems prudent. But the more offensive thing is the inclusion of high-yield corporate bonds. This one is baffling to me and is probably my most salient criticism. We know that corporate bonds in general are essentially a halfway point between treasuries and stocks, but junk bonds are highly correlated with stocks and are almost exclusively utilized for current income from their higher yield, which we don't care about at all in a long-term, buy-and-hold investment portfolio.

I'm not even an ardent subscriber to Larry Swedroe‘s reminder to “take your risk on the equities side,” but I see no logical explanation for the inclusion of junk bonds in this setting. I suppose the supporting argument might be to take on more credit risk, but then why not use foreign sovereign debt for that? Or again, if we're taking risk in bonds, use treasuries with a longer duration. Once again, diversification is supposed to be the focus, and junk bonds here don't really offer any that I can see. Myopically diversifying within an asset class, such as holding different types of bonds, does not always – and usually doesn't – equal more diversification for the portfolio as a whole.

Lastly, let's talk about precious metals. This means a basket of gold, silver, platinum, and palladium. A broad precious metals position such as this is more correlated with stocks compared to just holding the most popular one: gold. Once again, Green is perhaps looking at the diversification within the asset (i.e. holding multiple metals) instead of looking at the diversification of the portfolio as a whole, which is a faux pas that Harry Markowitz himself has warned investors about.

Just like with the bonds, holding multiple types sounds nice at first glance, making you think you're more diversified, but don't take the bait; it may actually hurt the portfolio as a whole after considering the other assets. That is, diversification via casting a wide net within an asset class (i.e. multiple metals, multiple types of bonds, etc.) may work against the diversification of the overall portfolio. This is a subtle but important distinction. And it's admittedly hard to wrap your head around at first. Basically, we're interested in the lowest correlation among different asset classes for the greatest diversification benefit, thus solely utilizing gold would be preferable in this case, similar to preferring solely using treasury bonds instead of including corporate bonds.

Ok, so maybe we should put that 5% in just gold. But now let's talk about that gold. Gold – or any metal – is not a value-producing asset, so it has a long-term real expected return of zero. In choosing diversifiers, even though low correlation – and preferably, no correlation – is important and desirable (gold is lowly correlated to both stocks and bonds), we still want the diversifier to have positive future expected returns, otherwise we're not really improving the risk-adjusted return of the portfolio. That is, an asset like gold invariably reduces the portfolio's volatility and risk but likely simply drags down its long-term total return.

Now I'll be the first to admit that this tradeoff – sacrificing returns to lower the portfolio's risk – may be perfectly acceptable, suitable, and even desirable for very-risk-averse investors or for retirees, but I'd imagine that for most people reading this who have a reasonably long investing horizon (myself included), an asset like gold only creates an opportunity cost where you could have held something else in its place – basically, that there are other things, like bonds and TIPS, that can do a better job than gold of achieving the same goal.

The usual argument for gold is that it's to hedge against inflation. First, we already have a healthy amount of TIPS and REITs for that. Secondly, gold has not been a reliable inflation hedge historically. Thus, with its small positive correlation to stocks, I think gold may offer a short-term diversification benefit and will likely reduce portfolio volatility and risk, but I invest for the long term and I try not to care about the short-term noise. Lastly, gold and metals funds always have higher fees, with broad metals funds being even pricier than gold funds, and also remember that gold in a taxable account is taxed as a collectible at 28%.

Conclusion

Everyone had been asking me to review this one for a while, so to be frank, I think I expected something a little more impressive, special, and research-backed. I recognize my criticisms may sound harsh, but Green makes a lot of glamorous promises and comments regarding diversification, performance, simplicity, and an evidentiary basis (Modern Portfolio Theory) for the Gone Fishin' Portfolio that just don't seem to hold up under the microscope, so I can't let him off the hook that easily.

This case reminds me a bit of the 7Twelve Portfolio, which I said seemed like a pro forma case of “diversification for the sake of diversification.” In this case with the Gone Fishin' Portfolio, diversifying more broadly within asset types results in neither greater expected returns nor a lower risk profile. Green talks so much about diversification, but the portfolio's constituent sources of risk are not very diversified.

Moreover, one can always choose assets first and then run an optimization algorithm on them within the framework of Markowitz's Modern Portfolio Theory, which may be what Green did here that resulted in junk bonds being included. This is sort of letting the tail wag the dog. One would ideally do the reverse, letting asset correlations and expected returns dictate – or at least influence – the specific assets chosen to include in the portfolio and the allocations thereof.

I've put my money where my mouth is by tweaking and backtesting the portfolio below with my proposed improvements.

My Modified Gone Fishin' Portfolio

I noted some changes I would make – that I would somewhat selfishly, perhaps egotistically view as objective, evidence-based improvements – in discussing the assets in the Gone Fishin' Portfolio above. Here are those specific changes, followed by the proposed portfolio allocations:

- Use U.S. small cap value instead of U.S. small cap blend.

- Use a single Developed Markets position instead of segmenting Pacific and European stocks.

- Increase the allocation to Emerging Markets even more. I've simply made them equal in weight to Developed Markets.

- Utilize long-term treasury bonds instead of short-term investment-grade bonds and high-yield corporate bonds.

- Throw the precious metals overboard. I just added that 5% to the REITs, so now the REITs weighting equals the TIPS position.

The resulting portfolio – I'll call it the “Modified Gone Fishin' Portfolio,” which looks fairly similar to my own portfolio – would look like this:

- 15% U.S. Stocks

- 15% U.S. Small Cap Value

- 15% Developed Markets

- 15% Emerging Markets

- 20% Long-Term Treasury Bonds

- 10% TIPS

- 10% REITs

Here's how my Modified Gone Fishin' Portfolio above would have worked out historically compared to the original:

In short, my modified version beats the original on every metric: higher general and risk-adjusted returns, lower volatility, and smaller max drawdown.

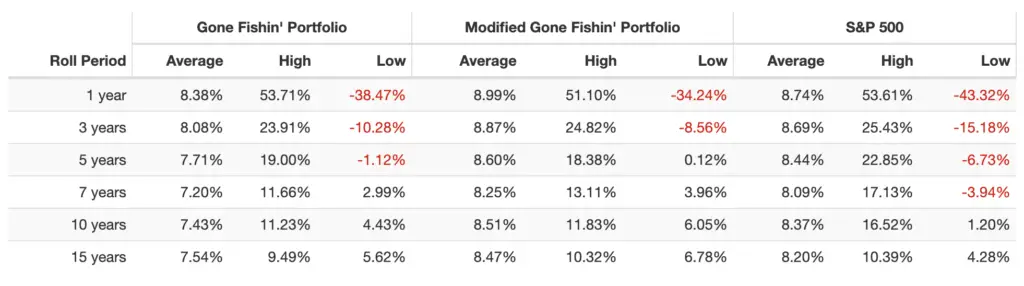

Here are the rolling returns:

Gone Fishin' Portfolio ETF Pie for M1 Finance

M1 Finance is a great choice of broker to implement the Gone Fishin' Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Using mostly low-cost Vanguard funds, we can construct the original Gone Fishin' Portfolio like this:

- VTI – 15%

- VB – 15%

- VPL – 10%

- VGK – 10%

- VWO – 10%

- BSV – 10%

- USHY – 10%

- SCHP – 10%

- VNQ – 5%

- GLTR – 5%

You can add the Gone Fishin' Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

My Modified Gone Fishin' Portfolio ETF Pie for M1 Finance

We can construct my modified version discussed above using the funds below. Conveniently, it can be built with fewer funds (greater simplicity) and lower fees (0.08% compared to 0.10%):

- VTI – 15%

- VIOV – 15%

- VEA – 15%

- VWO – 15%

- VGLT – 20%

- SCHP – 10%

- VNQ – 10%

You can add this Modified Gone Fishin' Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

Hopefully it will allow you to afford a better fishing pole in retirement.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosure: I am long VWO and VEA in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

John,

Being a long term investor and probably watching 90% of Wall $treet Week and using the Panel’s “hold for the year” investments, the TGPF was recommended and I read the book and followed it. As I read the article, one thing, since I have used Excel and Morning Star and Vanguard to analyze and project the growth was not clear.

Green’s book, from memory, recommends periodic tweaking…..so it is not exactly “Set and Forget”. A fellow commenter asked about dividend reinvestment. And the fact that you included that is good.

But, since you did not read the book, my question for your comparisons is this. Green’s basic or SIMPLE plan was you invested and then annually REALLOCATED the funds back to the original mix. Therefore, on every anniversary date, you were reallocated for the next year. I could not find information in your discussion that you were able to reallocated each year. Was that included in your comparison or are the values based on the total 20 odd year growth with dividends invested? If so, then can you perform or do you have the resources to do the annual reallocation? As an individual, I don’t have the data base or information….. If I did, then It would be easy in Excel to do that.

Very good article and It is great to revisit TGFP, but I need to see the actual annual allocation values after 20 odd years.

Thanks,

Sounds like you’re describing rebalancing. Backtests use annual rebalancing, which is typically what I suggest.

HI John, thanks for your insightful and articulate review of TGFP. I’ve been holding this portfolio spread across my ROTH, TRAD IRA, and Individual taxable accounts for about 10 years. What I am curious about is if the back tests include reinvested dividend/yield income?

Am I missing something?

Having read Green’s book he also spends quite a bit of time on taxes and does give specific advice to hold tax inefficient funds in IRA’s (which is what I’ve done and it’s been a challenge that I surmounted by making my own re-balance web program)

I am mostly curious to know if the back tests you’re providing do take into account reinvested dividends/yield.

thanks again and I’ll be reading more of your blog.

Very helpful!

Thanks, Chris! Yep, all backtests include dividends reinvested.

Thanks for sharing your thoughts John! This was a really informative review that winds up breaking down all kinds of fundamentals of portfolio construction, and I totally agree with your take. I prefer even numbers and have been experimenting with a modified version of this myself as an M1 Pie:

10% S&P500 US Large Cap

10% S&P400 US Mid Cap

10% US Small Cap/Value

10% Developed Markets

10% Emerging Markets

10% REITs

10% Gold

10% Long-Term Treasuries

10% Intermediate Investment-Grade Bonds

10% Short-Term TIPS

I’m sure you can easily see the logic of this version of the same slice-and-dice strategy – in backtests, it gets the volatility down closer to 10% StDev while adding a good 1% AAR. I generally like the idea of Gone Fishin but it really begs for a few sensible tweaks to improve the expected results.

Hi John, as someone who has implemented Alexander Green’s concepts in my retirement portfolio, I appreciate your review and the tone of “a reasonably long investing time frame..” My retirement time-frame is 2-3 years. Would you recommend change at this point?

Thanks, Seth. I can’t provide personalized advice and I don’t know your risk tolerance and goals anyway. I’d suggest assessing those things and choosing a strategy and asset allocation that fits them.

Hello John,

I found your discussion of Gone Fishing and other topics extremely lucid and helpful. As a retiree figuring out investment strategies, I am glad to have found your site!

That being said, maybe I missed something, but I think you are not correct when you write: “For example, when stocks zig, bonds tend to zag. Those 2 assets are uncorrelated.” You have repeated this elsewhere.

If stocks zig when bonds zag, they are, in fact, correlated, but the correlation is negative. I am a retired academic who has used correlations in my research. We distinguish positive correlations (two variables rise or fall together), from negative correlations (one rises and the other falls or vice versa), and from zero correlations (they move independently and so are uncorrelated.) . Stocks and bonds may balance each other, precisely because they are negatively correlated.

When selecting investments, it would seem to me (as a novice investor) that the differences among no correlation between asset classes, a positive correlation, and a negative correlation are meaningful. Please help me if I am wrong.

CP

Thanks, CP. Asset correlations are dynamic. On average historically, stocks and bonds have indeed been uncorrelated, with a correlation around zero. In recent years, and particularly since about 1982 with falling interest rates, this correlation has been negative on average, though not very strong. Very recently, this correlation has been increasing, but we primarily care about their extreme negative correlation during stock market turmoil when people “flock to safety” in treasuries. This behavioral aspect drives that negative correlation. But there are also intrinsic factors in bond markets that are indeed independent of equities markets. We can even find extended periods of a positive correlation between the two. Thus, generally speaking, it is likely most accurate to call them uncorrelated. I suppose I could be more precise with my verbiage though with the zig/zag thing. I’m very familiar with correlations; my background is in statistics.

Hi John, I noticed the S&P 500 performance here in this article is different from that in your Ginger ale portfolio analysis, though given same time span. Am I missing something? (Btw I love ginger ale too :p)

Different time periods.