Everyone needs a safe place for uninvested cash. Here I’ll provide an overview of a popular high-yield cash account from M1 to earn interest on your extra money in . Whether it’s for an emergency fund or short-term goals, everyone needs a safe place to park unused cash. Appropriately, we’d usually want to put that cash in what we call “cash-equivalent” … [Read more...] about M1 Earn High Yield Cash Account Review – 5.00% APY (2024)

Investing 101

1 ETF for Life to Get Rich? It’s Not One You’d Guess…

Is there one single ETF you can hold forever to get rich and save for retirement? Yes, and it's probably not one you would guess... Prefer video? Watch it below. If not, keep scrolling to keep reading. So I've referenced the famous Bogleheads 3 Fund Portfolio many times in various blog posts on this site, and for good reason - it's a simple, low-cost, … [Read more...] about 1 ETF for Life to Get Rich? It’s Not One You’d Guess…

How to Get 35% off a New Tesla Model Y (1.99% APR Financing Promo)

Here’s how to effectively save 35% on a new Tesla Model Y… Prefer video? Watch it below. If not, keep scrolling to keep reading. So Tesla is currently offering 1.99% APR financing on new Model Y’s through August 31, 2024: That’s almost free money. You can also extend the loan term to 6 years: I was curious to see how the numbers might play out … [Read more...] about How to Get 35% off a New Tesla Model Y (1.99% APR Financing Promo)

How to Get 33% off a New Tesla Model Y (0.99% APR Promo)

Here’s how to effectively save 33% on a new Tesla Model Y… Prefer video? Watch it below. If not, keep scrolling to keep reading. So I found it very interesting to learn that Tesla is currently offering 0.99% APR financing on new Model Y’s through May 31: That’s almost free money. You can also extend the loan term to 5 years: I was curious to see how … [Read more...] about How to Get 33% off a New Tesla Model Y (0.99% APR Promo)

Buy Borrow Die Strategy Explained – How the Rich Avoid Taxes

The Buy Borrow Die strategy is a tax minimization technique that has made headlines in recent years because it's what rich people like Jeff Bezos, Elon Musk, and Warren Buffett do to avoid taxes. Here we'll look at how exactly the strategy works and how you can use some of the same tactics as the wealthy to minimize your tax burden. Video Prefer video? Watch it … [Read more...] about Buy Borrow Die Strategy Explained – How the Rich Avoid Taxes

Whole vs. Term Life Insurance – Which Is Best for You?

Whole life insurance and term life insurance are pretty different. Here we'll go over their similarities and differences and pros and cons to decide why you might want one over the other, or neither. Term Life Insurance Term life insurance, as the name suggests, has a specified term length for coverage during which it will pay out if you die. That term could be … [Read more...] about Whole vs. Term Life Insurance – Which Is Best for You?

529 Education Savings Plan Explained – Invest for College + More

A 529 account or "529 plan" is a tax-advantaged investment account to save for future education expenses. Here we'll look at what it is and where, why, and how to open one. What Is a 529 Account? A 529 account, legally known as a “qualified tuition plan,” is named after section 529 of the IRS tax code. It is an investment account that allows for tax-advantaged … [Read more...] about 529 Education Savings Plan Explained – Invest for College + More

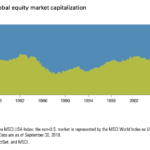

“Should I Invest in International Stocks?” Yes. Here’s Why.

The U.S. stock market isn't always king, and it doesn't really matter if it has been historically. Here I'll explain why that's the case and why it's probably a prudent idea for U.S. investors to also invest in international stocks. Video Prefer video? Watch it here: Introduction Make no mistake that the U.S. stock market usually dominates the global … [Read more...] about “Should I Invest in International Stocks?” Yes. Here’s Why.

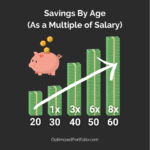

How Much You Should Save by Age 20, 30, 40, 50, and 60

While there's no one-size-fits-all approach for how much one should save by age, here's a general framework to aim for as you progress on your financial journey to retirement. Video Prefer video? Watch it here: Introduction - Savings Benchmarks by Age Obviously the specific amount of money you need as you get older will depend on your personal … [Read more...] about How Much You Should Save by Age 20, 30, 40, 50, and 60

No, There’s Not an “Index Fund Bubble.” Here’s Why.

The term index fund bubble has been thrown around frighteningly often in recent years. In this post I'll explain why there's not one and why the primary fundamental argument itself doesn't make much logical sense. Prefer video? Watch it below. If not, continue scrolling to keep reading. If you've arrived on this page, hopefully you already know that index funds are … [Read more...] about No, There’s Not an “Index Fund Bubble.” Here’s Why.

“Passive” Investing Is a Myth. Here’s Why.

Make no mistake that I'm a proponent of index investing, buying broadly diversified funds that hold a basket of investments, preferably at a low cost. I've even probably used the term "passive" cavalierly in other posts on this website. But in this one I'll explain why the idea of "passive" investing is a myth. Prefer video? Watch it below. If not, keep scrolling to … [Read more...] about “Passive” Investing Is a Myth. Here’s Why.

Return Stacking Explained – Greater Returns With Lower Risk?

Return stacking refers to applying a modest amount of leverage to a diversified investment portfolio of different asset classes in an attempt to ratchet up expected returns while simultaneously potentially lowering or at least maintaining risk. Here we'll look at what return stacking is and when, why, and how to do it. What Is Return Stacking? Return stacking is … [Read more...] about Return Stacking Explained – Greater Returns With Lower Risk?

Fees, Trees, & Forests – Stop Obsessing Over Expense Ratios

One of the core tenets of the Boglehead philosophy is to minimize fees whenever possible. That sounds reasonable enough on the surface, but here I'll explain why it's not so simple and why fees aren't as big of a deal as they're made out to be. Fees Are Relative If you've read any of my stuff on factor investing or specific small cap value funds, for example, … [Read more...] about Fees, Trees, & Forests – Stop Obsessing Over Expense Ratios

Employee Stock Purchase Plan (ESPP) Explained – Should You Buy?

An Employee Stock Purchase Plan (ESPP) is a program by which employees can purchase their employer's stock at a discount, but there are a lot of nuances to consider. Here I review the pros, cons, and some lesser known risks and strategies of ESPP's. What Is an Employee Stock Purchase Plan? As the name suggests, an Employee Stock Purchase Plan - or ESPP for short … [Read more...] about Employee Stock Purchase Plan (ESPP) Explained – Should You Buy?

Rule of 72 Explained – How It Works, How To Use, & Examples

The Rule of 72 in finance refers to a mathematical formula to illustrate compounding. Here we'll explore what it is, how it works, how to use it, and examples. What Is the Rule of 72? The Rule of 72 is simply a mathematical formula to estimate the number of years for an investment to double based on its rate of return. For a fixed income security like a … [Read more...] about Rule of 72 Explained – How It Works, How To Use, & Examples

Backdoor Roth IRA Explained – What, Where, Why, & How (2024)

A backdoor Roth IRA is a way for high income earners to indirectly contribute to a Roth IRA who would otherwise be ineligible. Here we'll look at what it is and where, why, and how to open one. What Is a Backdoor Roth IRA? A backdoor Roth IRA is a way for high income earners to still be able to contribute to the account from which they'd otherwise be ineligible … [Read more...] about Backdoor Roth IRA Explained – What, Where, Why, & How (2024)

Portfolio Rebalancing Explained – What, When, Why, and How

Portfolio rebalancing refers to adjusting the allocations of different assets to maintain a desired risk profile. Here we'll look at what rebalancing is and when, why, and how to do it. Video Prefer video? Watch it below. If not, keep scrolling to keep reading. What Is Portfolio Rebalancing? Portfolio rebalancing refers to bringing the assets in one's … [Read more...] about Portfolio Rebalancing Explained – What, When, Why, and How

Can Teenagers Open a Roth IRA? Here’s Why They Should

Yes, teenagers can open a Roth IRA. In this post we'll explore how and why investing in a Roth IRA can be extremely powerful for kids. What Is a Roth IRA? First let's do a brief recap of what exactly a Roth IRA is. A Roth IRA is simply a retirement savings vehicle that was established in 1997 to help U.S. citizens save for retirement. It is an individual … [Read more...] about Can Teenagers Open a Roth IRA? Here’s Why They Should

Traditional IRA Explained – What, Who, When, Where, & How (2024)

The Traditional IRA explained. This is a guide for the U.S. tax-deferred individual retirement account. Here we'll explore what a Traditional IRA is, who they're for, when to contribute, and where, why, and how to open one. Video Prefer video? Watch it below. If not, keep scrolling to keep reading. What Is a Traditional IRA? A Traditional IRA is simply … [Read more...] about Traditional IRA Explained – What, Who, When, Where, & How (2024)

Roth IRA Explained – What, Who, When, Where, Why, & How (2024)

The Roth IRA explained. This post is a guide for the U.S. tax-exempt individual retirement account. In it we'll explore what a Roth IRA is, who they're for, when to contribute, and where, why, and how to open one. Video Prefer video? Watch it here: What Is a Roth IRA? A Roth IRA is simply a U.S. retirement savings vehicle by which investors contribute … [Read more...] about Roth IRA Explained – What, Who, When, Where, Why, & How (2024)