AVUS is a relatively new ETF from Avantis that is a single fund solution for the U.S. stock market index investor who also wants some factor exposure. I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

Introduction – Factors and Avantis

If you've arrived on this page, I'm going to guess a couple things:

- You've heard of Avantis's proven track record and competency in factor investing.

- Generally speaking, you're probably a U.S. index investor for the most part with something like VTI or VOO (VTSAX or VFIAX for mutual funds) as a core holding.

Assuming that first one is true, hopefully factor tilts need no explanation, but we'll do a brief recap anyway. In a nutshell, we're talking about overweighting or tilting with certain risk factors in equities that have greater expected returns as well as a convenient diversification benefit.

Avantis, the new kid on the block that shares Dimensional DNA, have shown they're able to provide some of the best factor funds around. AVUS, which launched in late September 2019, is their ETF to broadly capture the U.S. stock market.

The Case for AVUS

Previously, the U.S. stock market ETF investor who also wanted factor tilts was probably using multiple ETFs, such as a combination of a plain low-cost broad market index fund like VTI from Vanguard plus a narrowly targeted small cap value fund like Vanguard's VIOV or Avantis's AVUV.

Achieving greater simplicity in one's portfolio by having fewer holdings to manage can be extremely valuable. AVUS may prove useful for the U.S. investor who wants to set it and forget it with a single fund for U.S. stocks.

AVUS was Morningstar”s “favorite new launch of the year” for 2019. The fund aims to achieve broad index-like exposure similar to that of VTI, Vanguard's offering for the total U.S. stock market, while simultaneously very slightly overweighting stocks with certain characteristics, such as a low price relative to its book value (called Value) and robust profitability, which should give AVUS a performance edge over the long term.

I use the word “slightly” very purposefully here because the factor loadings for AVUS are indeed very light, and may be too small for the die-hard factor investor. In this sense, AVUS is arguably more appropriate for the traditional index investor who wants to dip their toes into factors without feeling too much dissonance.

AVUS Performance

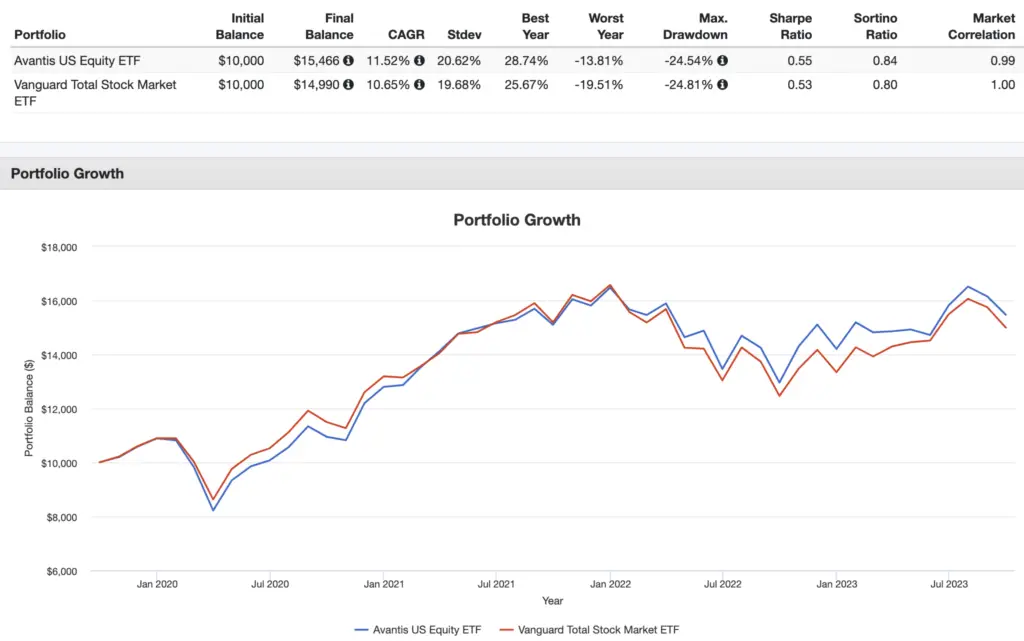

This exposure has indeed paid off so far. AVUS has beaten VTI in its short lifespan thus far looking at October 2019 through September 2023:

This is largely because Value stocks clobbered Growth stocks in 2022. I'll be curious to see if AVUS continues to pull away from VTI in the future over the long-term.

AVUS Factor Loadings and Composition

Specifically, here's a comparison of the factor loadings of VTI and AVUS since its inception in September 2019 looking through December 2022:

| VTI | AVUS | |

|---|---|---|

| Beta | 0.99 | 1.00 |

| Size | -0.02 | 0.07 |

| Value | 0.04 | 0.17 |

| Profitability | 0.04 | 0.05 |

| Investment | -0.02 | 0.00 |

| Alpha | -0.03% | 0.06% |

| R2 | 99.9% | 99.6% |

Notice how again, AVUS is basically holding slightly smaller stocks and stocks that are thought to be more undervalued. In theory, this should give AVUS a slight performance edge over the long-term.

In terms of sector composition, this effectively means AVUS is slightly overweighting sectors like Financials, Energy, and Utilities, and underweighting sectors like Technology relative to VTI.

Conclusion – Is AVUS a Good Investment?

So should you invest in AVUS? Maybe.

In my opinion, it's hard to conclude that these small factor loadings are worth the extra cost considering AVUS costs 5x what VTI costs. VTI has an expense ratio of 0.03% and AVUS has an expense ratio of 0.15%.

To put it simply, zooming out, AVUS doesn't look terribly different from VTI. But remember that was sort of the point in its design, so that's not a knock on Avantis. Again, as an arguably “moderate” factor tilter myself, AVUS looks pretty lackluster to me, but for the staunch Boglehead indexer, AVUS may be a perfect and attractive foray into factors.

The next obvious question is what allocation would it take to match AVUS's factor exposure with cheaper funds? Ironically, we can do that with a combination close to what investors were probably already doing before AVUS came along – 86% VTI and 14% AVUV.

This pairing comes out to a total fee of 0.06%, less than half the price of AVUS. I've created that portfolio pie here for those using M1 Finance.

If you prefer to stick with Vanguard funds, VIOV for the S&P Small Cap 600 Value Index is no slouch. Using VTI and VIOV, we can roughly match AVUS with the same allocation of 86% VTI and 14% VIOV. This combo has a fee of 0.05%, which is 1/3 the price of AVUS. I've also created this portfolio pie here for those using M1 Finance.

So it comes down to fee savings versus simplicity. Put another way, is that greater simplicity worth the greater cost? The choice is yours and it won't be the same for everyone.

You could also use those replications as substitutes for tax loss harvesting if we're talking about taxable space.

Note that in buying AVUS, you'll have basically zero exposure to REITs because Avantis exclude them in favor of their dedicated REITs product.

Conveniently, AVUS should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

What do you think of AVUS? Are any fellow Bogleheads going to switch from “VTI and chill” to “AVUS and chill?” Let me know in the comments.

Disclosure: I am long AVUV in my own portfolio.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply