The All Asset No Authority Portfolio is a medium-risk portfolio of 7 equally-weighted assets. Here we'll look at its components, performance, and the best ETFs to use in its construction.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

What Is the All Asset No Authority Portfolio?

The All Asset No Authority Portfolio – or AANA for short – comes from Doug Ramsey, the Chief Investment Officer at Leuthold & Co., a fund management firm that has been around for nearly half a century. Ramsey named the portfolio based on the idea that agnostically equally weighting the assets takes away the authority of the investor who would mess things up by overfitting or chasing recent performance.

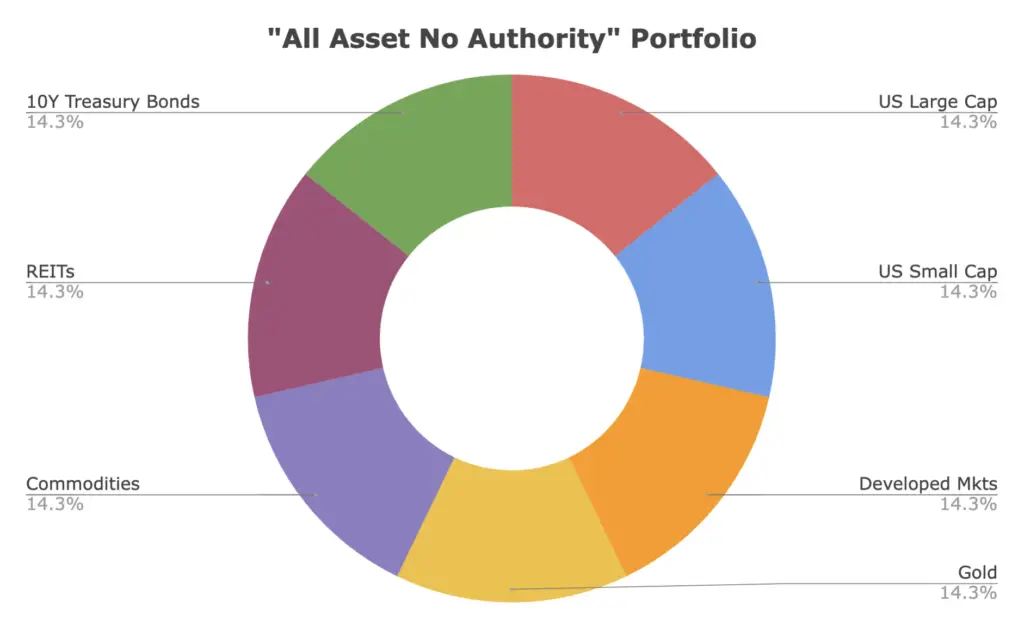

The All Asset No Authority Portfolio takes 7 assets and weights them equally at about 14.3% each:

- U.S. Large Cap Stocks

- U.S. Small Cap Stocks

- Ex-US Developed Markets

- Gold

- Commodities

- U.S. REITs

- Intermediate Treasury Bonds

At first glance, the All Asset No Authority Portfolio is reminiscent of other well-diversified portfolios built for all economic environments like the All Weather Portfolio, Permanent Portfolio, Ivy Portfolio, and David Swensen Yale Model Portfolio. Like those, it aims to provide lower volatility and lower risk by utilizing assets that may do well during inflationary periods relative to traditional stocks and bonds.

Ramsey suggests annual rebalancing.

All Asset No Authority Portfolio Performance and Review

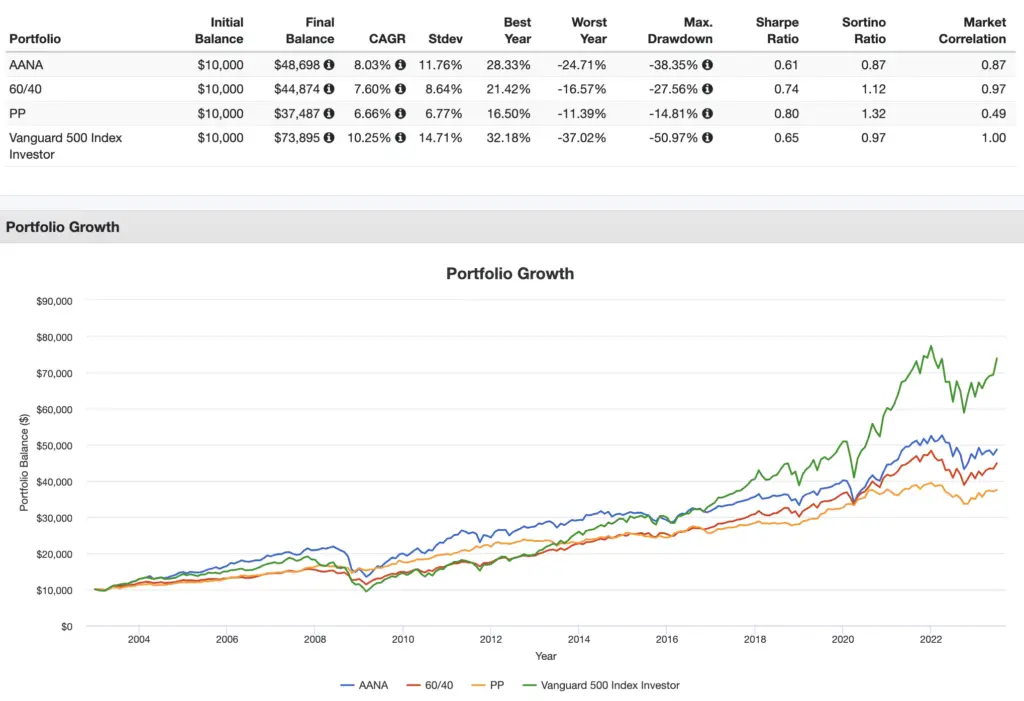

Here's the performance of the All Asset No Authority Portfolio over the last 20 years versus a 60/40 portfolio, the Permanent Portfolio, and the S&P 500 through June, 2023:

Over this period, the AANA Portfolio wasn't very efficient at delivering on its promises. We can see that both the 60/40 Portfolio and the Permanent Portfolio had significantly lower volatility and smaller drawdowns, and even the S&P 500 delivered a higher risk-adjusted return than the AANA Portfolio.

We should probably expect that result.

First, treasury bonds reliably offer the lowest correlation to stocks of any asset, but here they only get 14% of the portfolio and they're intermediate. I'd either make those long bonds or drastically increase the allocation. The risk-averse investor or the retiree should definitely want more in treasury bonds.

Secondly, the All Asset No Authority Portfolio allocates over 50% to purported inflation hedges in the form of gold, commodities, and REITs, but these are all pretty unreliable for that intended purpose. Gold and commodities have a long-term expected real return of about zero, and REITs don't appear to be a distinct asset class and tend to become highly correlated with the broader market during crashes. REITs also already comprise about 4% of the total stock market, so giving them an additional 14% here seems a little heavy.

Even Ray Dalio only gives 15% to gold and commodities in his famous All Weather Portfolio. That's probably about the maximum amount I would allocate to those assets as well, as a high inflation environment is relatively unlikely and would probably be short-lived. The rest of the time, those assets are almost certainly dragging down the long term return of the portfolio.

Speaking of inflation, the portfolio is also missing the asset most directly linked to inflation itself – TIPS (Treasury Inflation Protected Securities). These are also simply called inflation-linked bonds. If inflation is the primary concern for this portfolio, it makes little sense not to include TIPS. In fairness, they're a relatively new asset created in 1997.

Now let's circle back to the stocks allocation. We're equally weighting large caps and small caps, but only in the U.S. Why not also do so abroad? I'd also personally rather dedicate that small cap allocation specifically to small cap value stocks for greater expected returns and better diversification.

More offensively, though, we're only using Developed Markets for the international portion, which is half the size of the U.S. allocation. So we've got a huge U.S. bias, and Emerging Markets, which tend to offer a reliably lower correlation to the US and have paid a risk premium historically, are completely absent from the portfolio.

The All Asset No Authority Portfolio seems to want to maximize diversification, but doesn't seem to do a great job at accomplishing that. In my opinion, it has many of the assets one would find in a retiree's well-diversified portfolio, but in allocations that wouldn't be appropriate for most retirees.

Building The All Asset No Authority Portfolio With ETFs

Using my “best in class” ETFs, we can construct the All Asset No Authority Portfolio with the following funds, all at an equal 14.3%:

- VOO

- SPSM

- VEA

- GLDM

- BCI

- FREL

- SCHR

You can add this pie to your portfolio on M1 Finance by clicking this link.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

What do you think of the All Asset No Authority Portfolio? Let me know in the comments.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosures: I am long VOO and VEA in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply